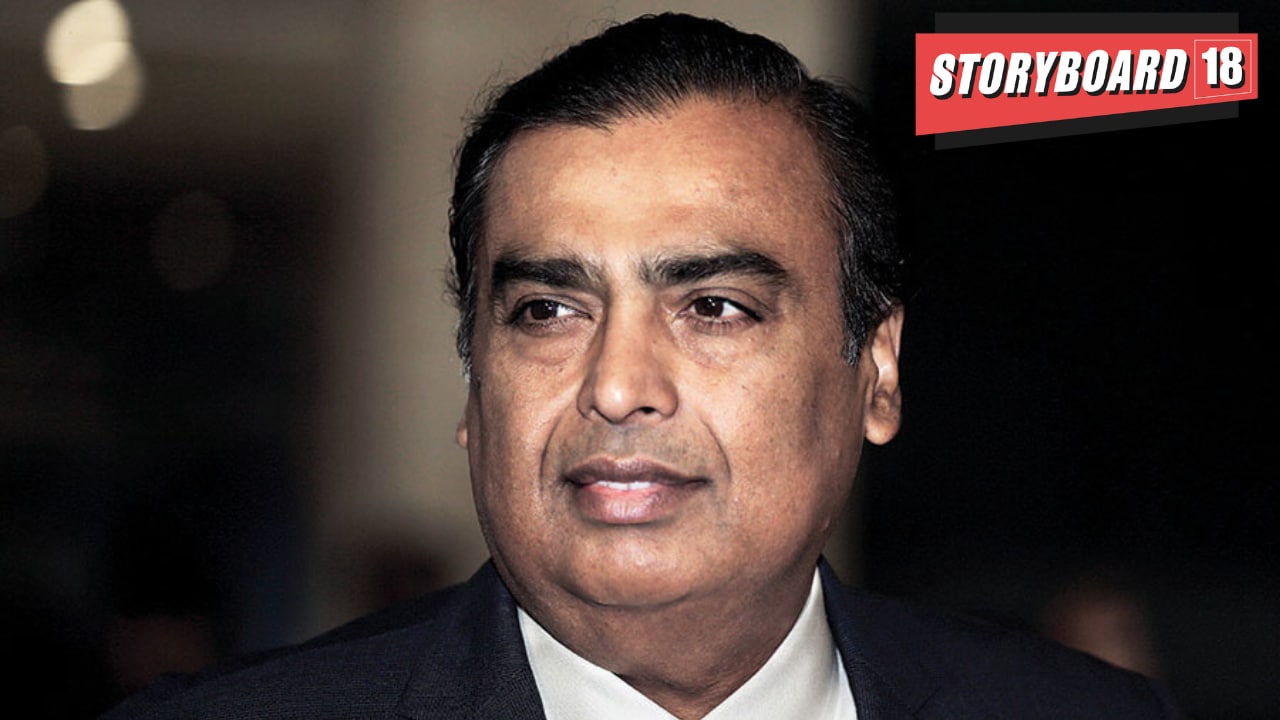

Mukesh Ambani-led oil-to-telecom-to-chemicals conglomerate Reliance Industries Ltd (RIL) on Monday, April 22, declared record annual earnings on the back of robust performance in its core oil and petrochemicals business along with sustained growth in its consumer-oriented retail and telecom divisions. The company reported a record annual consolidated revenue of over Rs 10 lakh crore, driven by continued growth momentum in consumer businesses and upstream business.

RIL’s quarterly net profit surged to Rs 18,951 crore in the January-March period of the financial year 2023-24, recording a 10% sequential jump, from Rs 17,265 crore the conglomerate had posted in the preceding October-December quarter. RIL’s net profit in Q4FY23 was at Rs 19,299 crore.

RIL’s revenue in the January-March quarter came in at Rs 2.37 lakh crore, higher than Rs 2.25 lakh crore it posted in Q3FY24 and Rs 2.13 lakh crore in Q4FY23.

Reliance became the first Indian company to cross the Rs 100,000-crore threshold in pre-tax profits. In FY24, Reliance also achieved the landmark of becoming the first Indian company to achieve a turnover of Rs 10 lakh crore.

RIL’s EBITDA (earnings before interest, taxes, depreciation and amortization) came in at ₹42,516 crore in Q4FY24, higher than ₹40,656 crore in the October-December quarter and Rs 38,440 crore in the same quarter last year. RIL Margin came in at 18% in Q4FY24.

Reliance Retail reported a 10.7% rise in revenue at Rs 76,683 crore, up from Rs 69,288 crore in the year-ago period. The earnings before interest, taxes, depreciation, and amortization (EBITDA) came in at Rs 5,829 crore, an 18.4% jump from the year-ago period. Reliance Retail’s margin in the quarter improved to 7.6% on account of mix and operating leverage. For the full year, Reliance Retail business crosses Rs 3 lakh crore topline.

“Acquisitions and partnerships continues to be a core part of our strategy for our consumer brands business. During the quarter we completed the acquisition of IP rights and trade, including trademarks and recipes for Ravalgaon,” said Dinesh Taluja, CFO and Corporate Development, Reliance Retail.

“For Jio Mart, our focus was to increase average order values, which were up 30% on a year by year basis, as well as increase the number of units per order, which is up 37% YoY basis,” said Taluja. “We also continue to enhance the functionalities of the platform to improve the shopping experience for the customer.”

Reliance Industries’ telecom arm Reliance Jio Infocomm saw its net profit rise 11% year-on-year (YoY) to Rs 5,337 crore for the January to March 2024 quarter. This beats the CNBC-TV18 poll projection of Rs 5,268 crore. Jio’s revenue for the March 2024 quarter came in at Rs 25,959 crore, up 11% YoY from Rs 23,394 crore.

Reliance Jio added 10.9 million subscribers during the quarter and an industry-leading subscriber addition of 42.4 million during FY2024. Reliance Jio’s ARPU (average revenue per user) came in at Rs 181.7.

Commenting on the results, Mukesh Ambani, Chairman and MD, RIL said: “…All segments have posted a robust financial and operating performance. This has helped the Company achieve multiple milestones. I am happy to share that this year, Reliance became the first Indian company to cross the Rs 100,000-crore threshold in pre-tax profits… With over 108 million True 5G customers, Jio truly leads the 5G transformation in India… Reliance Retail continued to provide customers endless choices through its robust omnichannel presence… Strong demand for fuels globally, and limited flexibility in refining system worldwide, supported margins and profitability of the O2C segment. Downstream chemical industry experienced increasingly challenging market conditions through the year. Despite headwinds, maintaining leading product positions and feedstock flexibility through our operating model that prioritises cost management, we delivered a resilient performance.”