From Xiaomi’s cheeky digs at Samsung and Apple to Mamaearth’s recent swipe at Lakmé and HUL, brands are trading subtlety for spectacle in what appears to be a revival — or reinvention — of comparative advertising. While the tactic itself is hardly new, its frequency, tone, and timing signal a strategic shift in how brands are navigating an increasingly crowded and combative marketplace.

“Comparative advertising is clearly having a moment — and not by accident,” says Ambika Sharma, Founder and Chief Strategist at Pulp Strategy. “Xiaomi’s latest campaign, taking a swipe at Apple’s ‘innovation,’ and Honasa’s cheeky callout of HUL are part of a growing trend of brands trading subtlety for spectacle.”

Read more: Xiaomi takes swipe at Samsung in print ad, continuing aggressive playbook against rivals

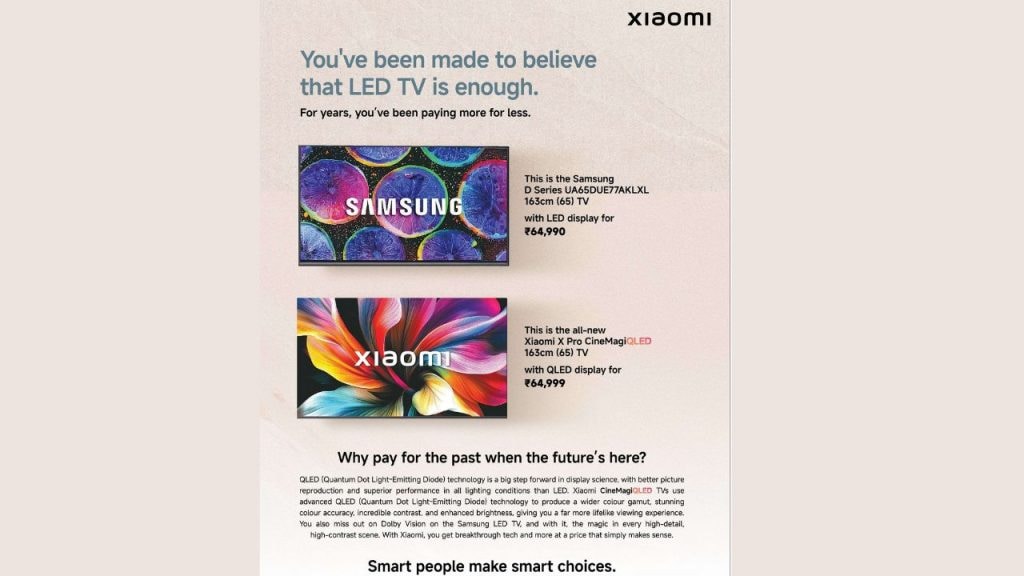

In its latest high-decibel marketing salvo, Chinese electronics brand Xiaomi has taken a direct dig at Samsung, targeting the South Korean giant’s LED TV lineup in a full-page print ad. The ad compares a Samsung 65-inch LED TV with Xiaomi’s own QLED offering, suggesting that consumers are being misled into “paying more for less.” Just last month, the company launched a full page print ad mocking Apple’s iPhone for lacking fast charging and other “standard” features.

Sharma believes this shift reflects not just marketing ambition but broader economic and geopolitical forces. “What we’re seeing is a content-level proxy war,” she explains. “Chinese-origin brands — Xiaomi included — are leaning into nationalism and relatability, using digital-first storytelling to challenge legacy dominance. It’s not just advertising — it’s strategy.”

She estimates Xiaomi’s media spend for FY24–25 could cross Rs 250– Rs 300 crore, focused heavily on short-form content, influencers, and performance marketing. “Their spend is agile and ROI-mapped — not always heavy on ATL, but deep in performance,” she adds.

In brand experts’ view, these ads are less about attention-seeking and more about narrative control. “In an age of AI-generated parity, brands are fighting to own the story, not just the product feature. And if that means punching up—or sideways-so — so be it.”

That said, experts acknowledge the risks: “Comparative ads work when they’re clever, factual, and emotionally relevant. When they aren’t, they just feel noisy.”

Experts Weigh In: Smart Strategy or Slippery Slope?

Naresh Gupta, Co-founder of Bang In The Middle, is more skeptical. “This is Xiaomi’s playbook. The easiest thing to do is create reflected glory,” he says. “Eventually, the brand will have to find its own appeal and move away from reflected glory.”

He warns that digital echo chambers are influencing real-world campaigns, and that hasty, reactive advertising can backfire. “When you mock the leading brand, it sells the leading brand,” he notes.

Samit Sinha, Managing Partner at Alchemist Brand Consulting, sees merit in the approach, but to an extent. “It reassures existing brand loyalists and may help bring the brand into the consideration set of new users,” he says. But he cautions that advertising works best through emotional resonance, not logic or one-upmanship. “Comparative advertising plays only a limited role in building brand equity.”

For Sandeep Goyal, Managing Director at Rediffusion, this is familiar territory. “Comparative advertising is as old as I can remember,” he says. “It helps in product placement and gives a trade a fillip.”

Although he’s unconvinced of its long-term value. “Just a passing fancy — soon forgotten.”

Read more: Mamaearth-Lakmé faceoff: Skincare brand wars heat up, HUL responds

Whether it’s about taking control of the narrative, clawing for salience in a saturated market, or reflecting deeper geopolitical posturing, comparative advertising is back — louder and sharper than before. But experts agree, it’s a high-risk, high-reward game that only works when it’s rooted in truth, creativity, and strategic clarity.

Brand consultant Nisha Sampath sees the trend as part of a larger shift in both category dynamics and global positioning. “It’s not just about individual brands — it’s a war of countries to claim equity in high-value goods,” she says, pointing to how Chinese audio brands disrupted Japanese legacies and how that same strategy is now being deployed in consumer electronics and even EVs.

She adds that the legacy vs. D2C tension is especially visible in beauty. “Legacy brands rely on trust and tenure. D2C brands like Mamaearth use science, clinical claims, and consumer truths to cut through. The fight is real, and the consumer ends up winning with more transparency and information.”

Comparative advertising might grab headlines and provoke reactions, but unless backed by product differentiation and long-term brand building, experts conclude, it risks becoming just another fleeting skirmish in the fight for consumer attention.