Arijit Singh, of ‘Tum Hi Ho’, ‘What Jhumka’ fame, raced ahead of global sensations like Taylor Swift, Justin Bieber and The Weeknd with an impressive follower count of 85,996,564.

Category: How it Works

How the Indian newspaper industry sees the impact of a newsprint price drop

Newsprint supply from Russia has also gained momentum after disruptions in shipping lines due to the EU and US sanctions, as per industry sources.

Elon Musk’s X Corp takes on content moderation law

X, the platform once known as Twitter, said the law known as Assembly Bill 587 violates its free speech rights under the US Constitution.

Rishi Sunak sports boAt headphones; Co-founders Sameer Mehta, Aman Gupta have priceless replies

UK Prime Minister Rishi Sunak shared a photo on Instagram where he’s seen wearing boAt headphones.

G20 Summit: Find out which hotels and cars Joe Biden, Rishi Sunak and other world leaders, delegations are using

The G20 Summit will see delegates from G20 and non-G20 countries hosted in Delhi on September 9-10.

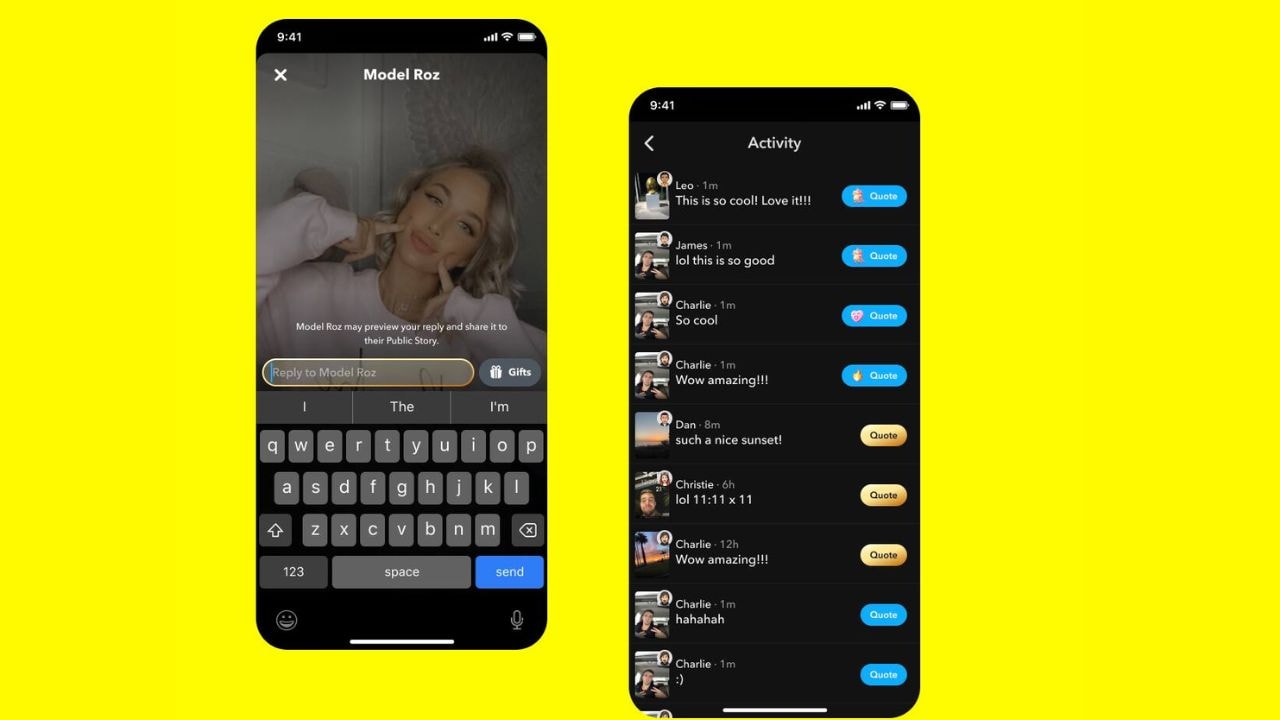

Snap to roll out safety features for teens

The goal is to help Snapchatters communicate with people that matter to them, and to ensure that the content they view on the app is informative, fun and age-appropriate.

Reliance, NVIDIA to develop indigenous large language model for AI in India

The companies will work together to build Al infrastructure that is over an order of magnitude more powerful than the fastest supercomputer in India today.

Livestreaming blurring boundaries between content and commerce, as per 80 percent CMOs: Dentsu Report

As per a report released by Dentsu Creative, 58 percent of marketers agree that today’s advertising isn’t entertaining enough in a crowded sea of bold and bullish promotional messaging.

ZEE Case: SAT sets new date for Punit Goenka vs. SEBI Case

SAT had withheld its judgment in the case, had instructed SEBI to submit a response by September 4.

Delhi HC refuses to restrain the usage of Policybazaar trademarks on Google Adwords

In its legal actions against Coverfox and Acko, Policybazaar alleged that these defendant companies were employing keywords identical to “Policybazaar” trademarks, such as “Policy Bazaar,” “PolicyBazaar,” and “Policy Bazar”.