Many advertisements, including influencer promotions, falsely portray earnings as risk-free, potentially violating ASCI and CCPA guidelines on deceptive promotions.

Tag: Online Gaming

AIGF, FIFS, EGF fail to convince Tamil Nadu government; RMG operators in lurch

On Friday, AIGF met with Tamil Nadu Online Gaming Authority (TNOGA) officials, only to receive instructions on implementation.

Tamil Nadu gaming authority to stakeholders: Implement regulations or face criminal charges

E-Gaming Federation on Tuesday met TNOGA officials Md. Nasimuddin and Dr. M.C. Sarangan to discuss issues pertaining to Tamil Nadu’s RMG regulations.

Delta Corp to sell DeltaTech Gaming to Head Digital Works in ₹491 crore deal

The consolidation of RMG companies are likely to increase due to uncertain regulatory policies and 28 percent GST regime impacting the industry.

RMG industry divided over Tamil Nadu’s online gaming regulations

The gaming federations will seek six months of time for the implementation while some RMG operators believe a formal lawsuit should be filed immediately, others are hesitant.

TNOGA Regulations enforced, RMG operators face compliance challenges

The regulations took effect on the date of publication in the Tamil Nadu Government Gazette, leaving RMG (Real Money Gaming) operators scrambling to comply with the new rules or risk criminal liability.

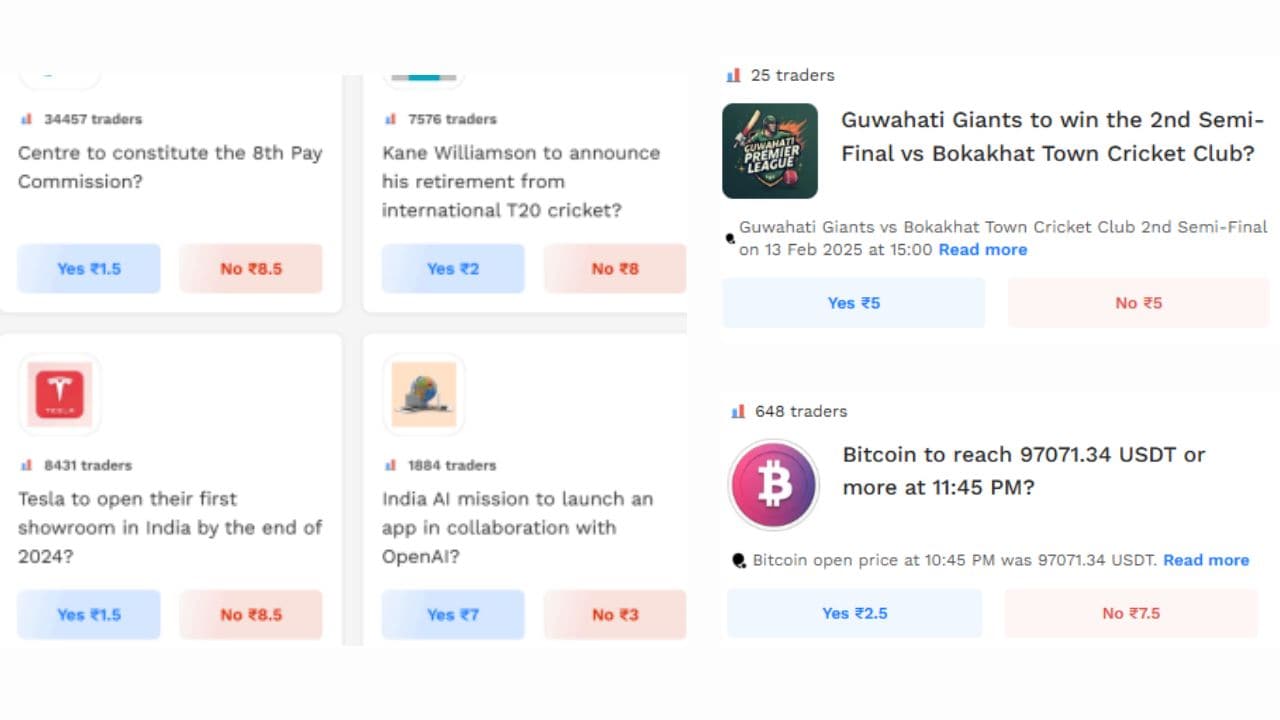

Industry stakeholders seek govt action against illegal betting apps

A representation letter will also be sent to Ministry of Consumer Affairs, Ministry of Information & Broadcasting, Ministry of Finance, SEBI and ASCI on the need to prohibit opinion trading platforms in India.

Finance Ministry to meet RMG operators on Friday, will discuss money laundering in online gaming

Stakeholders will also discuss challenges faced by the industry such as GST and penetration of offshore gambling companies in India.

TNOGA’s ‘Blank Hours’ regulation will push users to illegal gambling platforms, experts raise concerns

As RMG companies rush to assess the necessary technological changes, stakeholders express concerns about users from Tamil Nadu shifting to offshore gambling platforms during restricted hours.

Tamil Nadu vs RMG Industry: Fourth legal battle over online gaming restrictions

TNOGA Chairman Mohammed Nasimuddin had stated that preliminary survey analysis suggests that about 20 percent of students in the state are addicted to online games.