The European Commission has informed Google of its preliminary view that the company breached EU antitrust rules by distorting competition in the advertising technology industry (‘adtech’). The Commission takes issue with Google favouring its own online display advertising technology services to the detriment of competing providers of advertising technology services, advertisers and online publishers.

Google is a US multinational technology company. Google’s flagship service is its search engine Google Search. Google also operates other popular services, such as the video streaming platform YouTube or the mobile operating system Android. Google’s main source of revenue is online advertising: (i) it sells advertising space on its own websites and apps; and (ii) it intermediates between advertisers that want to place their ads online and publishers (i.e. third-party websites and apps) that can supply such space.

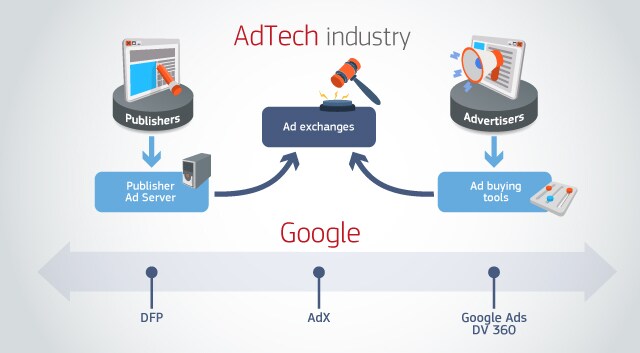

Advertisers and publishers rely on the adtech industry’s digital tools for the placement of real time ads not linked to a search query, such as banner ads in websites of newspapers (‘display ads’). In particular, the adtech industry provides three digital tools: (i) publisher ad servers used by publishers to manage the advertising space on their websites and apps; (ii) ad buying tools used by advertisers to manage their automated advertising campaigns; and (iii) ad exchanges where publishers and advertisers meet in real time, typically via auctions, to buy and sell display adds.

Google provides several adtech services that intermediate between advertisers and publishers in order to display ads on web sites or mobile apps. It operates (i) two ad buying tools – “Google Ads” and “DV 360”; (ii) a publisher ad server, “DoubleClick For Publishers, or DFP”; and (iii) an ad exchange, “AdX”.

Statement of Objections on Google’s practices in adtech

The Commission preliminarily finds that Google is dominant in the European Economic Area-wide markets: (i) for publisher ad servers with its service ‘DFP’; and (ii) for programmatic ad buying tools for the open web with its services ‘Google Ads’ and ‘DV360′.

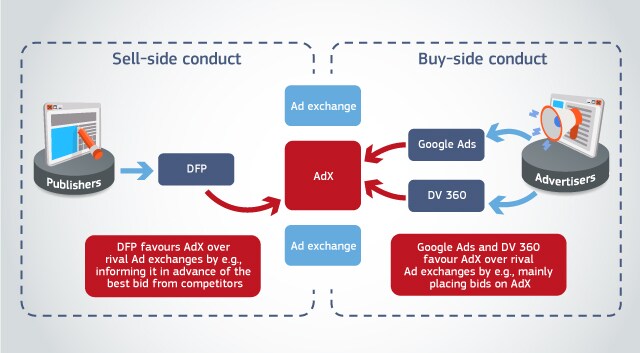

The Commission preliminarily finds that, since at least 2014, Google abused its dominant positions by:

1. Favouring its own ad exchange AdX in the ad selection auction run by its dominant publisher ad server DFP by, for example, informing AdX in advance of the value of the best bid from competitors which it had to beat to win the auction.

2. Favouring its ad exchange AdX in the way its ad buying tools Google Ads and DV360 place bids on ad exchanges. For example, Google Ads was avoiding competing ad exchanges and mainly placing bids on AdX, thus making it the most attractive ad exchange.

The Commission is concerned that Google’s allegedly intentional conducts aimed at giving AdX a competitive advantage and may have foreclosed rival ad exchanges. This would have reinforced Google’s AdX central role in the adtech supply chain and Google’s ability to charge a high fee for its service.

If confirmed, those conducts would infringe Article 102 of the Treaty on the Functioning of the European Union (‘TFEU’) that prohibits the abuse of a dominant market position.

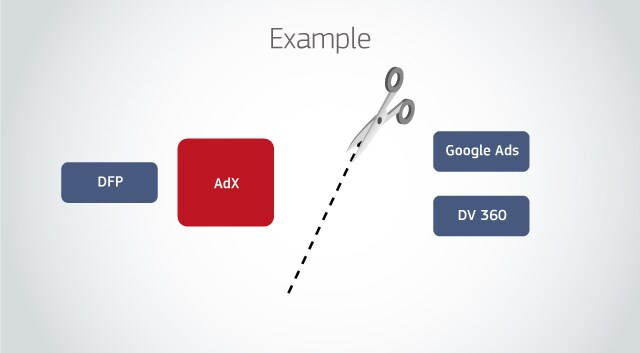

The Commission preliminarily finds that, in this particular case, a behavioural remedy is likely to be ineffective to prevent the risk that Google continues such self-preferencing conducts or engages in new ones. Google is active on both sides of the market with its publisher ad server and with its ad buying tools and holds a dominant position on both ends. Furthermore, it operates the largest ad exchange. This leads to a situation of inherent conflicts of interest for Google. The Commission’s preliminary view is therefore that only the mandatory divestment by Google of part of its services would address its competition concerns.

The sending of a Statement of Objections does not prejudge the outcome of an investigation.

Background

Article 102 of the TFEU prohibits the abuse of a dominant position. The implementation of these provisions is defined in the Antitrust Regulation (Council Regulation No 1/2003), which can also be applied by the national competition authorities.

On 22 June 2021, the Commission opened formal proceedings into possible anticompetitive conduct by Google in the online advertising technology sector

A Statement of Objections is a formal step in Commission investigations into suspected violations of EU antitrust rules. The Commission informs the parties concerned in writing of the objections raised against them. The addressees can examine the documents in the Commission’s investigation file, reply in writing and request an oral hearing to present their comments on the case before representatives of the Commission and national competition authorities. Sending a Statement of Objections and opening of a formal antitrust investigation does not prejudge the outcome of the investigations.

If the Commission concludes, after the company has exercised its rights of defence, that there is sufficient evidence of an infringement, it can adopt a decision prohibiting the conduct and imposing a fine of up to 10% of the company’s annual worldwide turnover.

Where the Commission, finds that there is an infringement of Article 101 or of Article 102 of the TFEU, it may by decision require the company concerned to bring such infringement to an end. For this purpose, it may impose on them any behavioural or structural remedies which are proportionate to the infringement committed and necessary to bring the infringement effectively to an end. Structural remedies can only be imposed either where there is no equally effective behavioural remedy or where any equally effective behavioural remedy would be more burdensome for the company concerned than the structural remedy.

There is no legal deadline for bringing an antitrust investigation to an end. The duration of an antitrust investigation depends on a number of factors, including the complexity of the case, the extent to which the undertakings concerned cooperate with the Commission and the exercise of the rights of defence.