Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

Category: Special Coverage

Storyboard18 – Power Of Purpose: Mapping out the path to a sustainable future

Storyboard18 and Network18 Group’s Power of Purpose: Sustainability Edition dialogues will take place on October 18 in New Delhi. Hear voices from across the spectrum – policy makers to India Inc leaders to frontline change-makers across generations, share insights and impacts that matter.

Broadcasters chart action plan | Disney Star trains Dubai Police | Noel Tata appointed Chairman of Tata Trusts

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

Broadcasters and DPOs clash | Ratan Tata passes away at 86 | ZEE gets a clean chit

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

TN Govt’s strong message to RMG industry | Kaya’s Group CEO Rajiv Nair resigns

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

Festive ads surge | Jamba to debut in Mumbai | Women in marketing face challenge

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

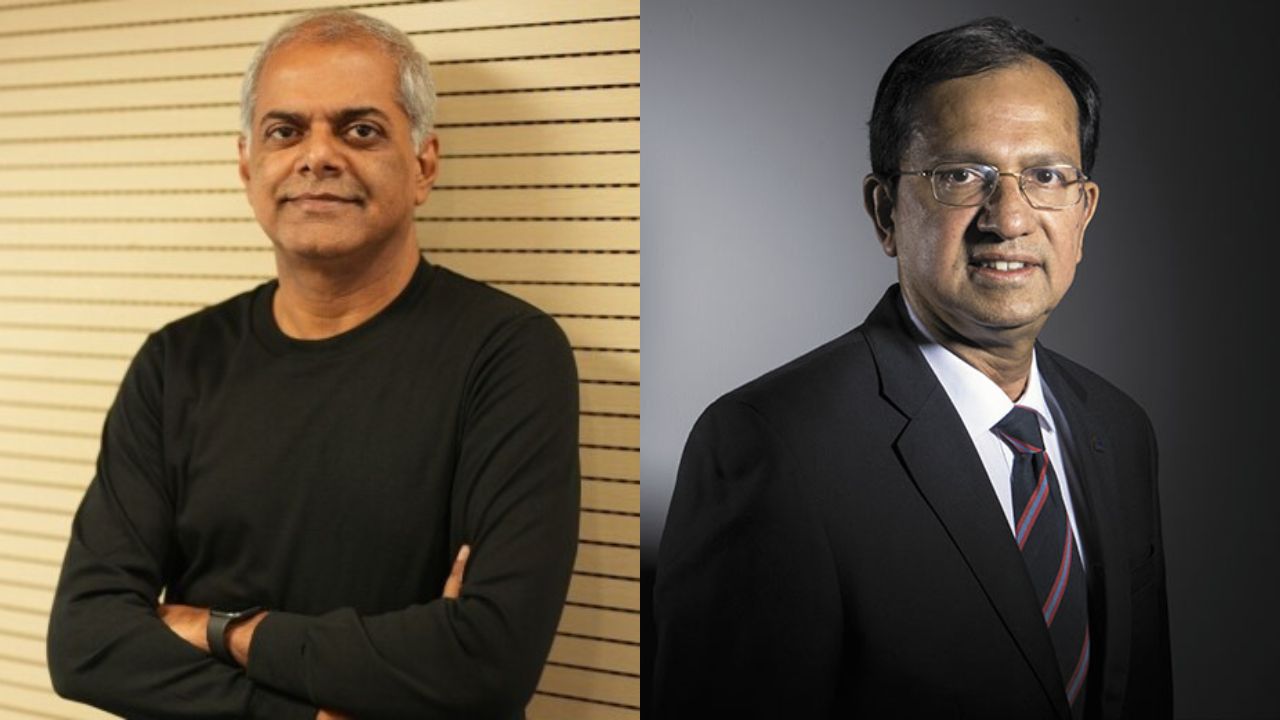

Manish Tiwari to be Nestle India’s MD | AAAI re-elects Prasanth Kumar as President; Rana Barua becomes Vice President

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

Big blow to Mamaearth by UAE court | Liquor brands hike ad spends | W+K shuts Mumbai office

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.

Beyond the startup hype: The hidden costs of a hustle culture

In India, women are more likely to have or develop a mental health issue than men, as per Aon’s report on mental health.

E-comm, q-comm and the future of kiranas | Disney Star onboards Dream11, Hero | OTT advertising to grow

Storyboard18 brings you top five news updates from the world of advertising, marketing and business of brands.