Hyperlocal e-commerce platform Magicpin expects an annual revenue rate of $100 million by the end of this year, founder Anshoo Sharma told Storyboard18. According to Sharma, Magicpin’s run rate has increased by 100% to $60 million in 2023 from $30 million in 2022. The company’s annual run rate was $15 million in 2021. The delivery firm has planned to expand its operation to tier-1 cities and states’ capitals. Sharma said that Delhi and Bengaluru are the company’s big players at the moment but the startup is also present in Pune, Hyderabad, Mumbai, Pune, Chennai, and Kolkata.

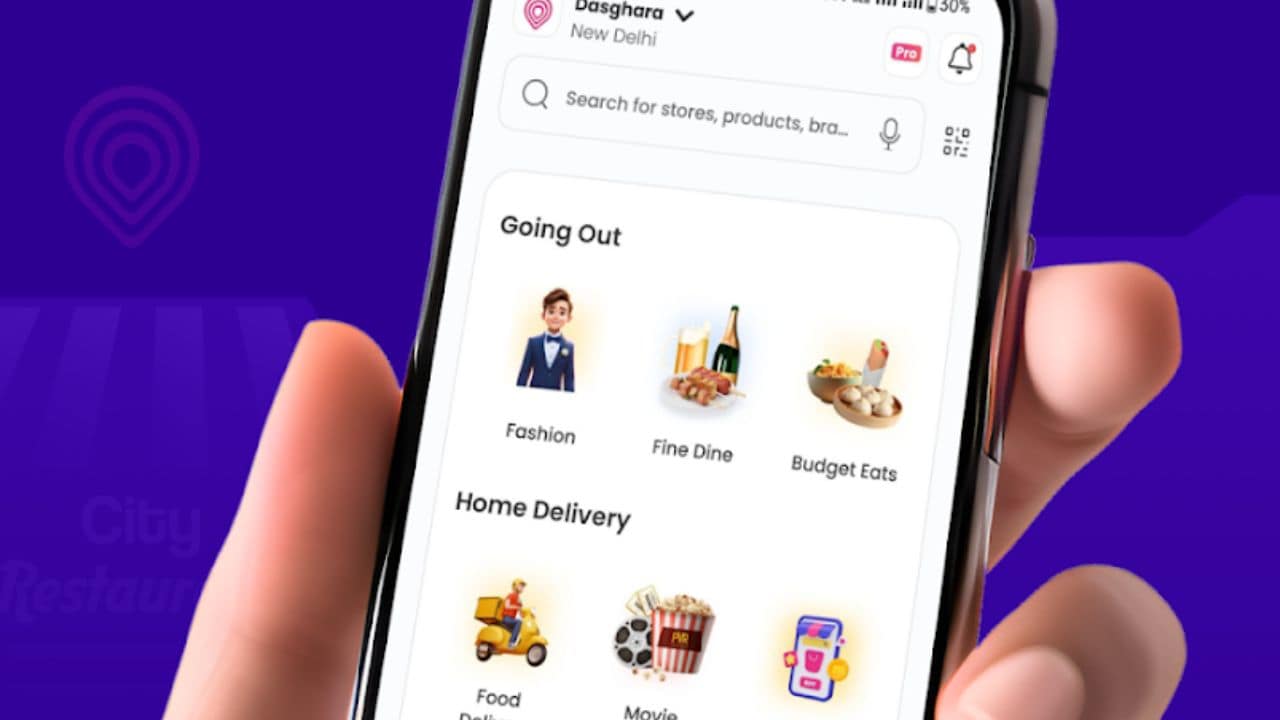

On ONDC, Sharma said that the government-backed network has been one of the “key ingredients” to its growth. Magicpin, one of the largest restaurant aggregators, joined Open Network for Digital Commerce (ONDC) in March 2023. The Gurugram-based startup is one of the leading seller apps on ONDC. Its food tech vertical competes with food delivery apps like Swiggy and Zomato.

Notably, ONDC has captured 3 percent of the food order volumes managed by Swiggy and Zomato. On the other hand, Sharma estimated that Magicpin may have a 10% market share in key markets like Delhi or Bengaluru as compared to Zomato (market share between 50-55%) and Swiggy (40-45% of market share). “In about 1.5 years we have double-digit market share in major cities,” he said.

Zomato has 15.4% stakes in Magicpin as per the Tracxn data. Lightspeed Venture Partners has remained the largest stakeholder with 32.8% shares post-allotment. Magicpin is planning to onboard over 1 lakh new restaurants and cloud kitchens on ONDC by the second quarter of FY25.

“Through ONDC, we are deeply working with Ola which has a large fleet of delivery, comprising electric vehicles (EVs), and that gives us the advantage to be more cost-efficient”. “We have around 2.5 lakh merchants in the ONDC network,” Sharma added.

Calling Magicpin an “anti-burn organization, the startup’s founder said that he is frugal in spending on marketing and advertisement. “We mostly burn our cash on merchants”, Sharma added. “Our acquisition cost is low. Initially, we spend around Rs 10,000 to Rs 20,000 on a merchant, which includes putting signage at their store, helmets for the rider, etc. Besides, other expenses include discounts on initial commission, spending on influencers for marketing for merchants among others.”

Sharma said that his primary goal is to grow the business and generate cash. As per the data by Tracxn, Magicpin’s valuation was $323 million as of January 2022. The company’s annual revenue was Rs 315 crore ($39.2 million) as of March 31, 2023.