When we first meet, InMobi and Glance co-founders Piyush Shah and Abhay Singhal have just flown into town, from Singapore and Silicon Valley respectively. We’re at the JW Marriott in Mumbai’s Juhu, trying to find a quiet corner at the bustling café, and their eyes dart around.

“This brings back so many memories,” Singhal, who is also CEO of InMobi Ads, says. InMobi started out of Mumbai, and 15 years ago, back when they didn’t have a nice enough office to call clients in to, they would park themselves right here, Singhal recalls, nostalgically.

And now, all these years later, the duo is part of the co-founding team that built India’s first unicorn, InMobi, an advertising technology company. InMobi was also India’s first profitable unicorn, and the first Indian company that Softbank invested in, back in 2011. Today, the team also runs another unicorn, called Glance, which now has its sights set on Softbank’s home turf, and one of the toughest markets in the world: Japan.

At A Glance

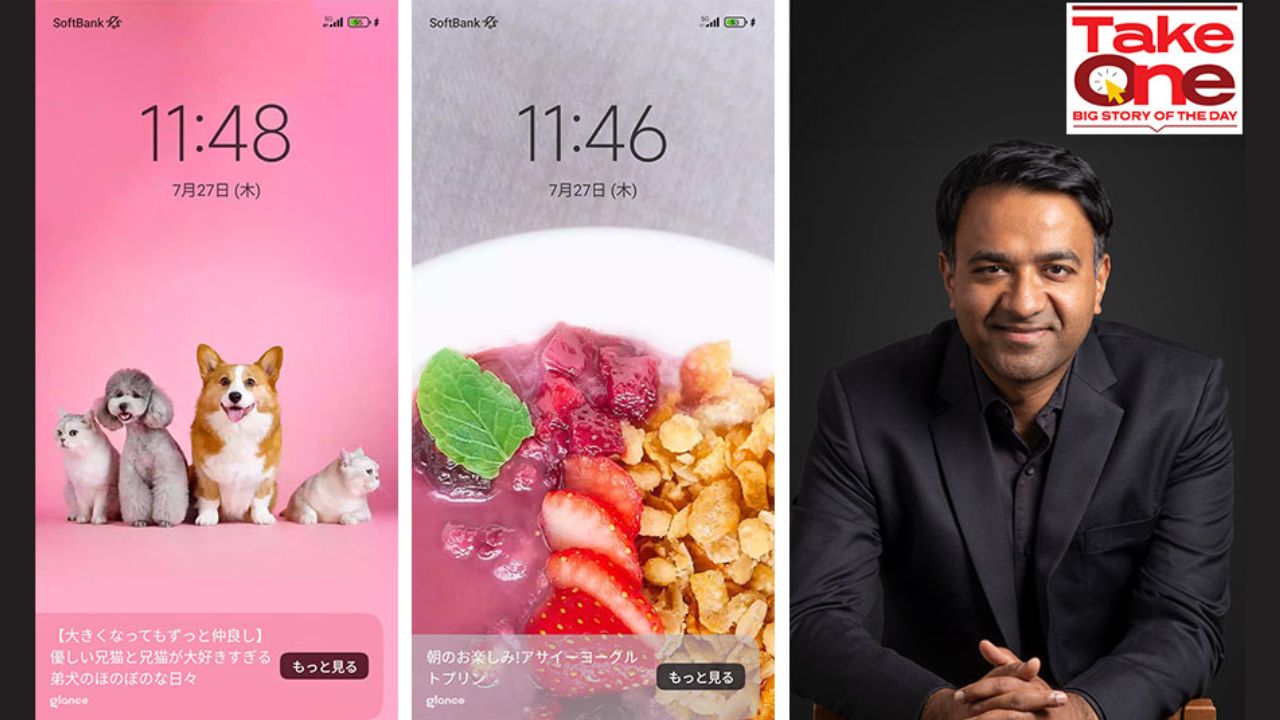

Glance, founded in 2019, uses artificial intelligence to deliver personalised content to a mobile phone user’s lock screen. It comes pre-loaded on various Android phones, and offers curated content ‘at a glance’, without having to unlock your phone, and without having to download a separate app. Users can feed in their preferences, and turn on filters as relevant, and read the news, follow sports, play quick games or learn trivia, watch live-streamed events, even shop, right from their locked screens.

Glance is currently available on 450 million smartphones around the world, and its biggest markets are currently India and Indonesia. Headquartered in Singapore, Glance is an unconsolidated subsidiary of InMobi Group and is funded by Jio Platforms, Google, and Mithril Capital. It turned to unicorn status in 2020.

In India, Glance was present on 44 percent of smartphones in Q3 2022, according to Counterpoint research. More than 80 percent of the Glance active users belong to the sub-$250 price segment, and its active user base crossed 195 million in 2022, adding 32 million active users in the past year, with 20 percent year-on-year growth. Its users were mainly using phones from Xiaomi, Samsung, Vivo, Oppo and Realme.

“Smartphones have become an inevitable part of people’s lives, resulting in a higher pace of content absorption and more competition in content generation,” Arushi Chawla, research analyst at Counterpoint Technology Market Research, wrote in her analysis. “This is where Glance, with its lock screen service grabbed the opportunity to bridge the gap between content production and content consumption by making the process of content discovery possible at the very first touch by the users on their Android smartphones. Glance aims to reach smartphone users in the most seamless yet consumable form.”

More recently, Glance has been looking to experiment with device types, launching on smart TVs to capitalise on idle screens. Glance also operates Roposo, a live video and shopping platform, and Nostra, a gaming platform.

Globally, Glance is aiming to be on more than one billion phones in the next two years. The platform has over 230 million active users, primarily in India and Indonesia, while it has recently launched in Brazil, Mexico, and Colombia.

In its next phase, Glance is switching gears from emerging economies to focus on two tough and very different markets: First Japan, and later, the US.

“The lock screen has remained an underexplored avenue for consumer interaction, despite the growing daily smartphone usage. Content creators are actively seeking opportunities to capitalise on this trend,” Tarun Pathak, research director, Counterpoint Research, says. “With its prominent presence on Android devices, Glance has emerged as a leader in this space.”

“Having already established a significant foothold in markets like India and Southeast Asia, where personalised content through video stories and live streaming has been their forte, Glance’s expansion into other Asian markets is a strategic move that could potentially redefine content delivery and user engagement,” Pathak adds.

Tokyo Drift

“We’ve been building Glance as a B2C consumer internet platform, starting with India, then Indonesia and south-east Asia, and Latin America,” Piyush Shah, Co-founder of InMobi Group and COO & President of Glance, says. “This is the first time we’re taking it to a developed market, but we’ve been clear that the model, the product remains the same.”

Glance works deeply with publishers and OEMs (original equipment manufacturers). In Japan, Glance is already available to subscribers of telco SoftBank Corp using Xiaomi (Redmi Note 9T Redmi Note 10T, and 12T Pro) and Motorola (Moto G53y 5G) smartphones. In the upcoming quarters, it aims to expand its presence to other big carriers and Android smartphone brands in Japan.

Initially, Glance consumers in Japan will be able to discover news, trending content, and gaming on their lock screens. Content and experiences on Glance are powered by Japanese publishers, including Yahoo Japan Corporation (Partners of Yahoo! News), LINE Digital Frontier Corporation, SoftBank Corporation (Baseball LIVE, Basket LIVE), and more.

Japan is different from the other markets Glance has tackled before, starting right from its user base.

“It’s a premium, high average revenue per user (ARPU) market, and we’ve seen a lot of positive user response in our research phases, which is why we are keen to be there,” Shah says. “So far, a lot of our focus has been on the youth, people buying their first or second smart phones. Interestingly, in Japan, we see an older target audience, and we were pleasantly surprised that they loved the product and how simple and visual it is.”

The average age for the Japanese target user is 48.7, versus in India and Indonesia, where the average user is at half that age. Glance has invested in setting up a local team, head by Masato Ito, who has previously worked for ByteDance and Shutterstock.

“Japan is currently an unhealthily iOS dominated market, at about 60 percent,” says Ito. “The iOS users are typically younger; in older Japanese users, we see more Android usage, with an even split of male and female consumers.”

Even so, content consumption habits are being seen as mostly universal: Breaking news, sports, food, lifestyle and entertainment are popular, with certain localisation, such as in Japan, manga is popular. Gaming, too, is entrenched in Japanese culture.

“While Japan incubated gaming, Indonesia is a massive gaming market as well. We’ve learned from Indonesia that people love playing games, but also love watching gamers live streams, and that’s working well in Japan too. We’re also seeing that telcos and OEMs are leveraging Glance as a differentiator, and it could help Android grow in the market,” Shah says.

The bar in Japan, Shah adds, is much higher, as consumers hold you to a different standard. “We’ve seen the quality of Japanese companies,” he says. “Customers are definitely less tolerant, so it was very important that we feel confident that we are offering a premium product. The other part is to be able to attract advertisers who will eventually help us monetise. We know going in that it’s a big bet.”

The team has been working on the expansion for the last year-and-a-half, getting publishers and partners on board. Glance now has a 20-member team dedicated to Japan.

“We know that this is going to be one of our top 3 markets globally, along with India, and eventually, the US,” Shah says. “We aspire to own almost 40 percent of the Android market share over the next couple of years.”

In the past decade, the first phase of innovation has come from the West, and the second phase from China, with apps like TikTok. Glance’s team is keen that India be a key character in the next phase of innovation.

“For our team, building the first unicorn was great, and being the first profitable one was even better. Having a second unicorn was phenomenal. But building a consumer tech platform out of India that can truly go global? That, we think, could be our legacy,” Shah says.