India’s sports industry has witnessed a significant uptick in media spends, growing by 7% in 2024 to reach Rs 7,989 crore, according to GroupM’s latest Sporting Nation report. The growth signals a steady rise in investments across various sports properties, driven by increasing viewership, brand engagement, and the expanding digital ecosystem.

Despite macroeconomic challenges, the Indian sports industry continues to attract higher media investments, the report concluded. This marks the 12th edition of the annual report on the Indian Sports Industry from GroupM ESP, the Entertainment & Sports division of GroupM.

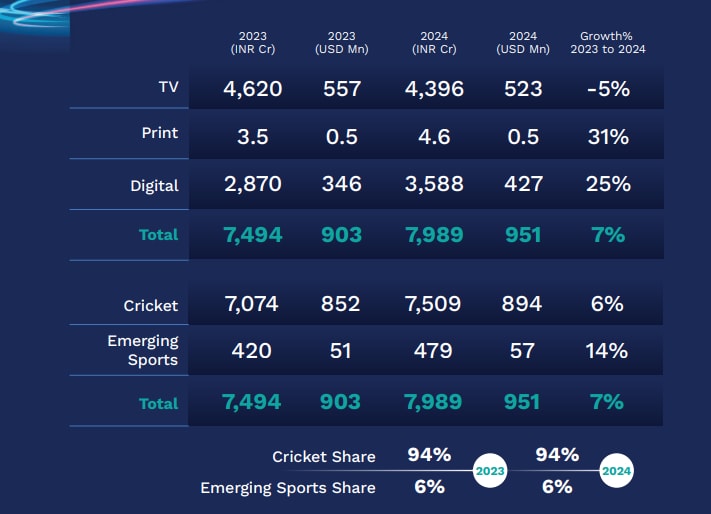

The sports adex in 2023 (with TV contributing around Rs 4,620 crore, followed by digital at Rs 2,870 crore and print at Rs 3.5 crore) stood at Rs 7,494 crore, which increased to Rs 7,989 crore in 2024. In 2024, TV ad spends in sports stood at Rs 4,396 crore, followed by digital at Rs 3,588 crore and print at Rs 4.6 crore.

Cricket contributed around Rs 7,509 crore (vs. 7,074 in 2023) to the overall media adex, whilst emerging sports stood at Rs 479 crore (vs. 420 crore in 2023). “Sports media spends on the verge of crossing the $ 1 bn. mark. TV media spends on sports stayed stagnant because of lesser number of matches that India played in 2024 as against 2023,” the report said.

The sports sponsorship spends stood at Rs 7,421 crore in 2024 with an incremental growth of only 1% over 2023 (Rs 7,345 crore). Endorsement spends stood at Rs 1,224 crore in 2024, witnessing a 32% increase over 2023 ( Rs 927 crore). Overall, the sports revenues stood at Rs 16, 633 crore in 2024, inching closer to $ 2 billion. This was up from Rs 15,766 crore in 2023.

The number of matches that team India played in CY2024 was lesser – 44 Matches in 2024 vs. 64 Matches in 2023. CY2023 was the last of the previous sponsorship cycle in both – IPL and ICC. While IPL renewed Title Partnership at Rs 500 crore/yr and associate partners at an avg. of Rs 93 crore/year, IPL 2022 and 2023 was an anomaly – with 100% fill rate in terms of sponsors.

The report also shared that the total athlete endorsement spends crossed Rs 1,000 crore for the first time in 2024, and reached Rs 1,224 crore – up 32% over 2023.

Vinit Karnik, Managing Director, Content, Entertainment & Sports, GroupM India, said, “The Indian sports economy has firmly established itself as a high-growth sector, surging 7x since 2008 to near the $2 billion mark. While traditional powerhouses continue to drive momentum, the real story lies in the rise of emerging sports, athlete-driven brand value, and digital explosion, which alone saw a 25 per cent jump in media spends. The record-breaking Rs 1,224 crore in athlete endorsements signals a shift—brands are betting big on individual icons across sports. As we enter a new era of engagement, innovation will be key in unlocking the next wave of commercial success in Indian sports.”

The rise in athlete endorsement was driven not just by cricket, but also by icons like Neeraj Chopra, PV Sindhu, and Manu Bhaker, with a 46% increase in non-cricket endorsements.

According to the report, 2024 saw healthy growth in sponsorship spends in emerging sports. With an upswing of 19% over 2023, they delivered a total value of Rs 1,811 crore ($ 216 Mn). The Paris Olympics gave an impetus to the business of these sports. 2024 saw the Pro Kabaddi League (PKL) receiving robust support from brands like Dream 11 and Shriram Finance; Indian Super League (ISL) pushed the ball forward. The year also saw successful execution of Ultimate Table Tennis (UTT), Ultimate Kho Kho (UKK), and Prime Volleyball League (PVL), marking the early stages of their respective journeys.

In 2024, IPL saw a reach of over 5.07 million in terms of TV with TV ratings of 3.06. IPL’s social conversations stood at over 18,600, with an online mention of 17,800 on X, a reach of 25,000 on Facebook, and 11,000 on Instagram.