IPL 2023 is halfway through and advertising agencies are working on the last stretch of brand campaigns for this season. While traditional advertisers have taken a large pie of the advertising spends this year, new-age companies, particularly those in the edtech, fintech, and e-commerce sectors, have remained cautious. However, that hasn’t changed the energy in advertising corridors and the quantum of work coming their way.

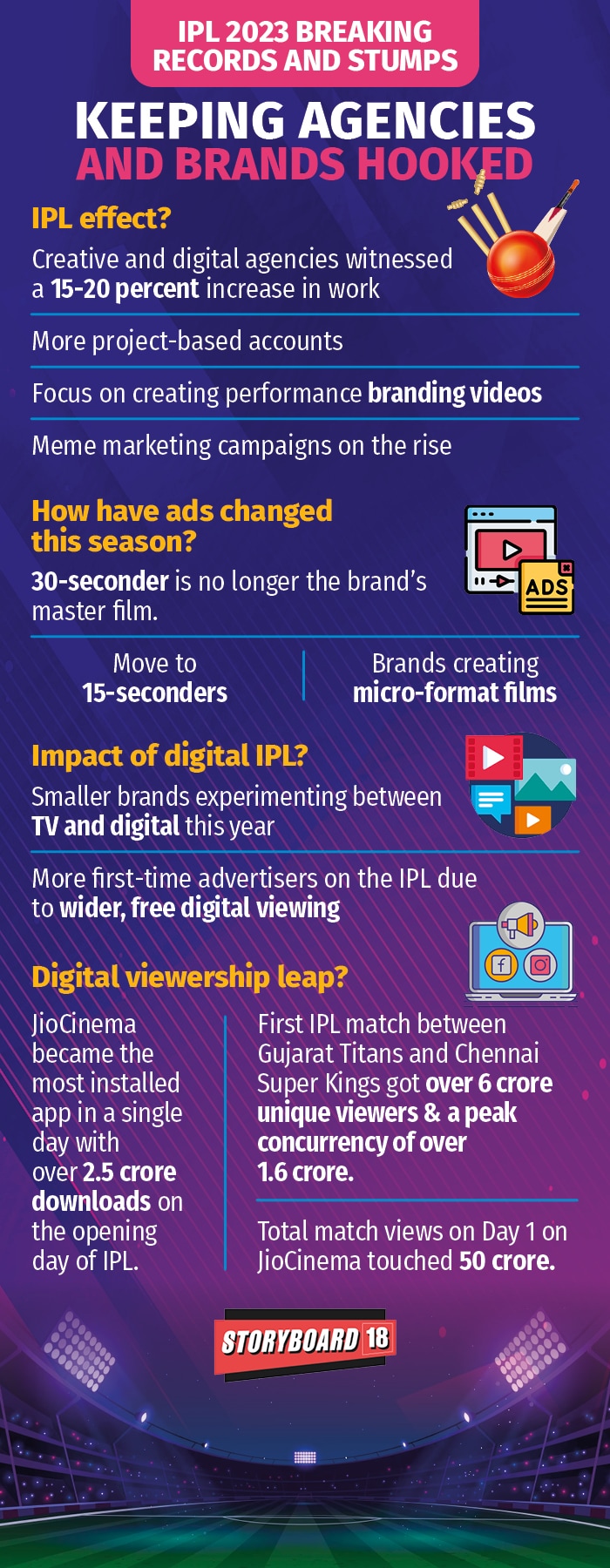

Various creative and digital agencies that Storyboard18 spoke to indicate that they have witnessed a 15-20 percent increase in work during IPL 2023; making it the second-busiest advertising season of the year. First, of course, is the festive quarter.

Mitesh Kothari, co-founder and CCO, White Rivers Media, says that his Mumbai-based digital agency, has worked on various project-based accounts to create performance branding videos and meme marketing campaigns that capture the exciting moments of the tournament. At the moment, the agency is working on 10-12 IPL campaigns for brands like Vida V1 Electric Scooters, Real Me, Swiggy Dineout, among others.

One of the highlights in this season of IPL has been Punjab Kings pacer Arshdeep Singh’s stump-breaking performance. Many leveraged this moment on Twitter including Swiggy, Tinder, Durex, and Ixigo. Even Mumbai Police jumped in and didn’t miss out to break the clutter on the micro-blogging platform.

How I feel in the middle seat ✈️ https://t.co/AyipivOOsu

— ixigo (@ixigo) April 23, 2023

Action is most likely to be taken on breaking the law, not stumps! https://t.co/bo8jgafACm

— मुंबई पोलीस – Mumbai Police (@MumbaiPolice) April 22, 2023

this is what third wheeling feels like 👀 https://t.co/EnFuAuJksR

— Tinder India (@Tinder_India) April 22, 2023

That agencies get busier leading up to the IPL is no surprise because few platforms offer brands a springboard like the IPL. What has changed this time is the fact that advertisers are expected to get big bang for their buck as IPL this season is high on digital viewership.

JioCinema set a new record for being the most installed app in a single day with over 2.5 crore downloads on the opening day of IPL. The first IPL match between Gujarat Titans and Chennai Super Kings garnered over 6 crore unique viewers and a peak concurrency of over 1.6 crore on JioCinema, becoming one of the most-watched events on the platform. The total match views on Day 1 on JioCinema touched 50 crore.

The official broadcaster Disney Star also signed ad deals with as many as 13 brands, including many traditional advertisers such as Asian Paints, Charged by Thums Up, Airtel, Cadbury Dairy Milk, Mountain Dew, Parle Biscuits, Kamala Pasand, Rupay, Britannia, Jindal Panther, and LIC, according to the network.

This year’s broadcast features expert panels and commentary spanning 12 languages including English, Hindi, Telugu, Tamil, Gujarati, Bengali, Marathi, Punjabi and Bhojpuri. Snippets of Punjabi and Bhojpuri commentary went viral too. Viewers and IPL players took to social media to praise the diversity in commentary. Media executives think this is a welcome change and will increase the reach of the league across the country, giving advertisers more opportunities to target regional audiences.

Entry of new advertisers

Shashi Sinha, CEO, IPG Mediabrands India, tells Storyboard18, that smaller brands are experimenting between TV and digital a lot more this year. The outlays may be smaller but the number of such campaigns has seen a sharper rise, says Sinha. There are also several first-timers on the IPL’s advertising gambit, this year.

For instance, legacy condom brand Kamasutra is leveraging IPL advertising for the first time through the “Make Love Last Longer” campaign on JioCinema. The move on being present in the league through digital platforms is an outcome of how consumers’ media consumption is evolving.

Pooja Sahgal, chief marketing officer, Raymond Consumer Care Ltd (RCCL) notes that the brand’s media mix ratio has evolved from being television heavy (70-80 percent spends) to now digital taking 55 percent of the overall spends.

“Television advertising has restrictions for condom advertising (on GEC, brands can only advertise after 10 pm) but then we have OTT and YouTube and even IPL on JioCinema. Through that we could really reach the consumers any time,” she says.

Kamasutra’s digital strategy is video heavy where they leverage different formats of video on social media platforms. “Half of our digital media ad budget goes into video format then we have social media marketing (mostly Instagram as well as Facebook) and the remaining goes into influencer marketing (leveraging sexperts),” she explains. A big trend for Sahgal is meme marketing. Adding a touch of humour when talking about sex makes it more acceptable and comfortable for Indian audiences, it seems.

New and evergreen trends

T Gangadhar (Gangs), group CEO and co-founder, Quotient Ventures, says that they do see a bump-up in inbound enquiries ahead of this marquee event – mostly from ambitious brand owners wanting to make a mark on the national stage.

As far as creative trends go, the key one for him is that, ads featuring celebrities continue to hog a disproportionate share of visibility – both through direct endorsements and team sponsorships. “How to stand out amid a plethora of celebrity messages is the challenge facing agencies and brand owners now,” he adds.

Ashish Khazanchi, managing partner, Enormous Brands, sees a different format emerging with the IPL bonanza. He says that with digital slowly taking the centre stage a 30-seconder is no longer the brand’s master film. It is moving to 15-seconders and going forward brands will want agencies to look at creating more of micro-format films. Enormous Brands has worked with bike taxi aggregator and logistics service provider Rapido for their IPL campaign.

Ajay Gupte, CEO, Wavemaker, South Asia, opines there are few advertising vehicles which create attention and consistent viewership like IPL. While the cost of investment on advertising during IPL is increasing every year, Gupte says, this has led a few marketers to look at the league from a different lens. He explains, “Today, marketers are looking at IPL as a part of their regular media plan and not putting all their monies on it.” This is helping new brands to come on board even if their spending is not high. Gupte sees this as a welcome and strategic change.