Getty Images and Shutterstock, two giants in the stock image industry, announced a landmark merger aimed at creating a $3.7 billion powerhouse. The deal, however, is expected to attract significant antitrust scrutiny, given its potential to reshape the competitive landscape, Reuters reported. The merger will also streamline operations, expected to generate annual cost savings between $150 million and $200 million by the third year.

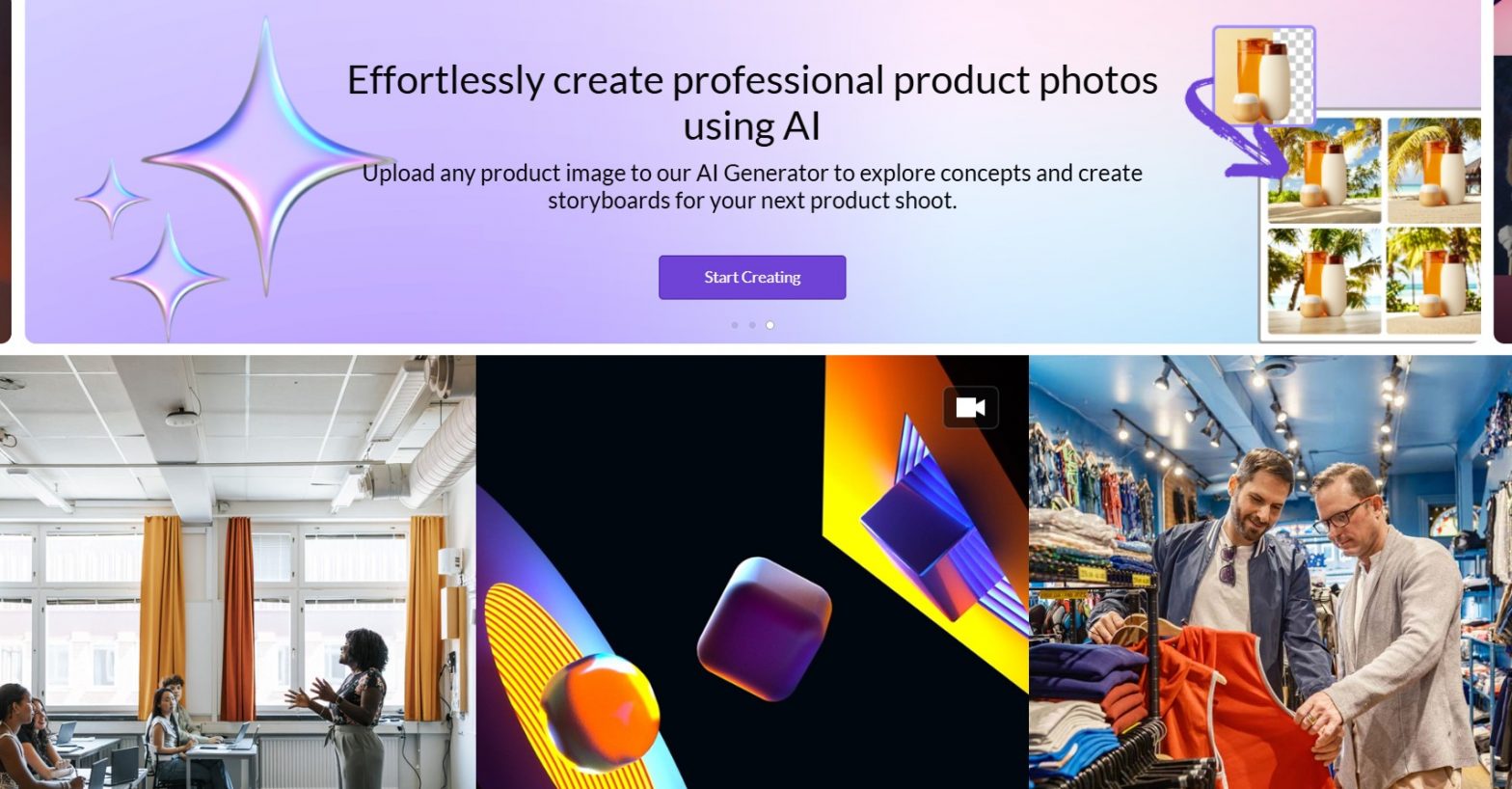

The merger comes as the licensed visual content sector faces growing challenges from AI-driven tools such as Midjourney and OpenAI’s DALL-E, which can generate realistic images and videos from simple text prompts, presenting a new form of competition for traditional stock photography.

The announcement sent their stock soaring, however, both companies have seen their stock prices decline over the past several years, as the increasing prevalence of smartphone cameras has diminished the demand for stock photography.

The new company will be called Getty Image Holdings, according to the press release.

“With the rapid rise in demand for compelling visual content across industries, there has never been a better time for our two businesses to come together,” said Getty Images chief executive Craig Peters.

“By combining our complementary strengths, we can better address customer opportunities while delivering exceptional value to our partners, contributors, and stockholders,” he added.

Peters will be the chief executive of the new company, which will be chaired by Mark Getty, the current chairman of Getty Images, which he co-founded in 1995. Getty Images investors will hold a controlling 54.7% stake in the combined company, with Shutterstock shareholders owning the remainder.

Getty competes with major players such as Reuters and the Associated Press in supplying photos and videos for editorial use, and the merger represents a significant consolidation in an industry facing rapid technological disruption.