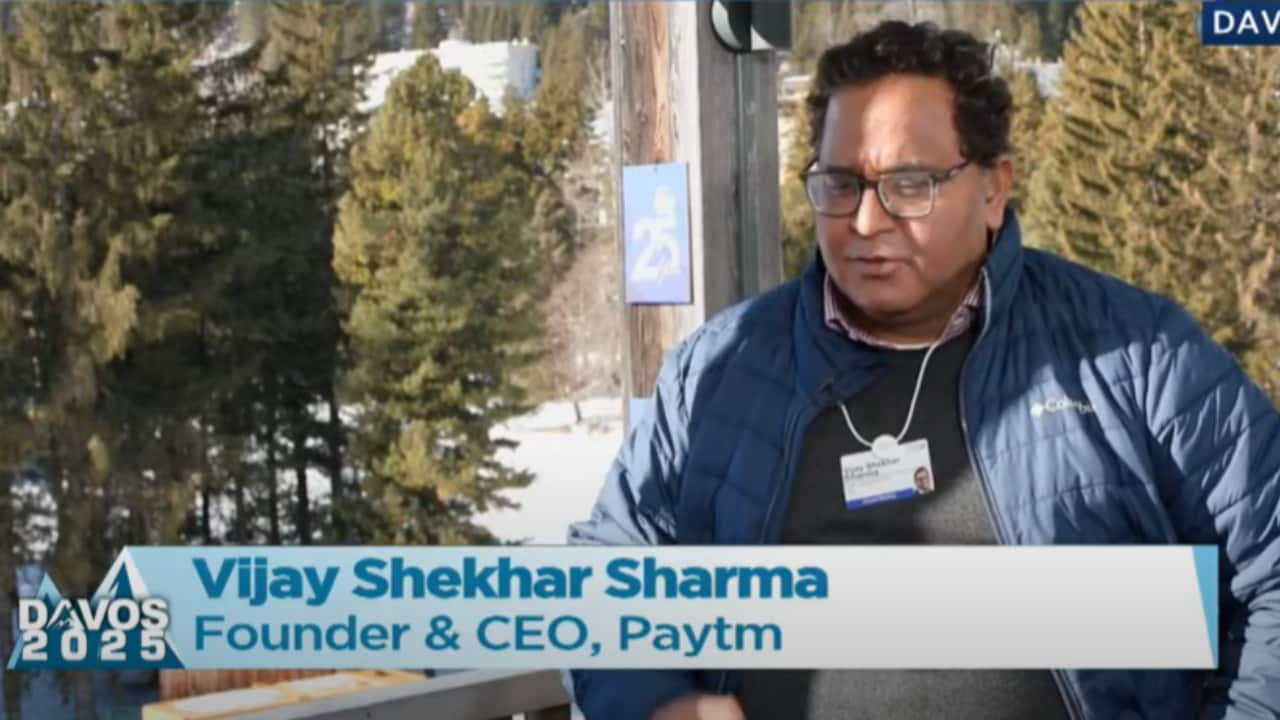

Paytm, the prominent digital payments company, is positioning itself for profitability in the coming quarter, as announced by its Founder and CEO, Vijay Shekhar Sharma. Speaking with CNBC-TV18’s Shereen Bhan at the World Economic Forum in Davos, Sharma confirmed that the company has set a goal to achieve positive earnings before interest, taxes, depreciation, and amortization (EBITDA) for the next quarter, excluding employee stock option plan (ESOP) costs.

“We have committed that next quarter we will be profitable — EBITDA before ESOP,” Sharma stated, expressing confidence in Paytm’s path to financial stability. He attributed the company’s promising outlook to its substantial cash reserves and a streamlined cost structure that has enabled it to move closer to profitability.

While Paytm’s financial performance appears on track, the company is also navigating challenges in its position within the United Payments Interface (UPI) ecosystem, where its market share has sharply dropped to 5.5%. Sharma, however, remains optimistic about the company’s ability to recover lost ground, attributing the market share decline not to issues of trust, but to external regulatory hurdles.

“Our business was paused due to regulatory challenges,” he explained. “We weren’t allowed to onboard at all. However, since the pause was lifted, I’m happy to report that we’ve been adding millions of customers without any marketing spend.”

Despite the setback, Sharma is confident that the company’s recovery is imminent, largely due to Paytm’s product offerings and deeper integration into the UPI ecosystem. “It’s about bridging product gaps and enhancing our integration with UPI, alongside expanding merchant acquisition,” he noted. “This will create a flywheel effect that brings our consumers back.”

Addressing concerns about market share, Sharma was hopeful but pragmatic, stating that while the decline was significant, it remains recoverable. He emphasized the importance of increasing product features and expanding Paytm’s presence in consumers’ daily lives to regain traction. He added, “We do have a marketing budget, but right now we are focused on product-led growth.”

“Our brand recall is strong, and our product features provide us with a competitive edge,” he said, signaling that with the right product-driven strategy, Paytm’s market share will increase in the coming quarters.