I must start by admitting that I was a sceptic when Zepto launched its under 10min delivery service! After all who has grocery emergency on a regular basis? I was quite happy with Big Basket with its wide assortment, good quality and next day delivery.

In early 2023, at Elevate Insights, we ran a survey with 600 online grocery shoppers across 6 metros and found that majority seemed to be in the same camp. A 30 min delivery was seen to be appropriate for the few top-up occasions while majority grocery occasions were categorized as planned with no rush for delivery.

Zepto not only promised delivery under 10mins but also provided discounted merchandise and charged no delivery or handling fees. Everyone wondered how that would ever make for a viable business model?

Fast forward to 2024: Zepto is now 80% of my total household grocery purchases with 30-40 orders in a month. Its become my all-in-one source for milk, fresh produce and grocery given the competitive prices with rocket like delivery service. I must admit that now even 15 minutes somehow seems an awfully long delivery time. 4 hours or next day delivery are redundant! I am even willing to pay INR 99 a month for this convenience, partially sweetened by some discounts here and there!

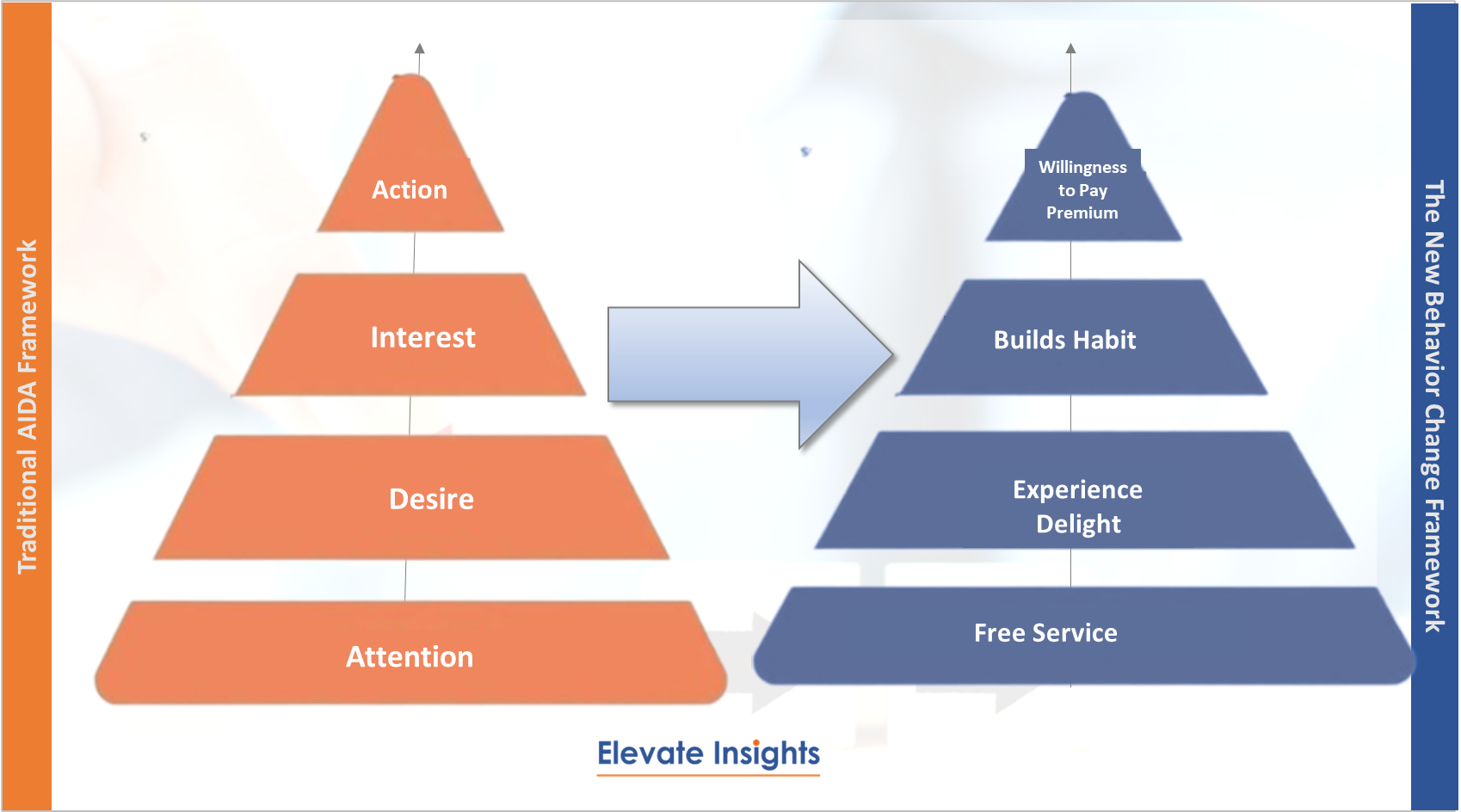

The Changing rules of habit formation

Philip Kotler taught us that Awareness Consideration Trial Usage. Zepto and the likes have shown us that Free Service Experience Delight Builds Habit Willingness to Pay Premium A Good Investment.

Foodtech players also tried the same model of habit creation via deep discounting and attractive offers in the early days. However, eating out frequency for the Indian diaspora is nowhere close to daily milk and grocery replenishment and hence Quick commerce has become the centre of gravity even for Swiggy and Zomato.

The Race to be in the Q Commerce game:

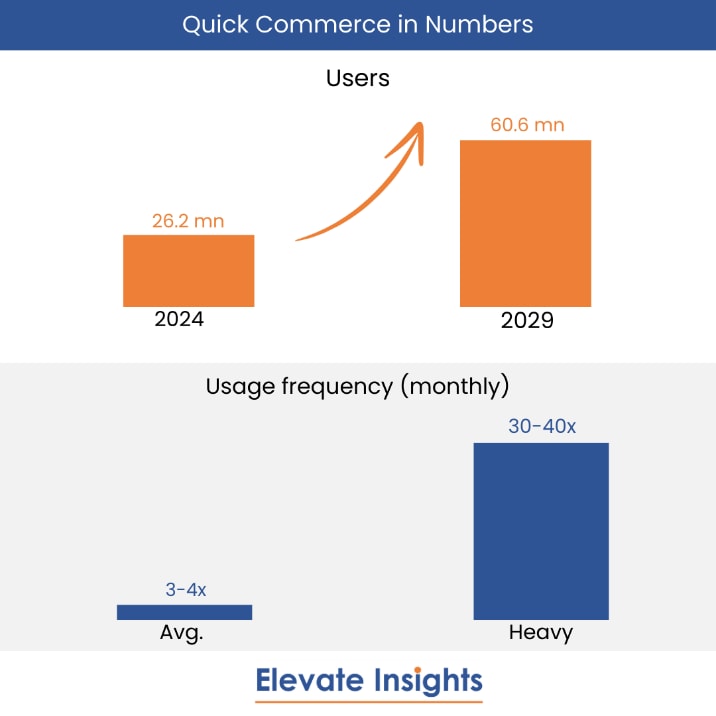

Even as quick commerce is fading in many markets with several heavily funded startups having folded shop, India is emerging as a striking outlier having witnessed a staggering tenfold growth between 2021 and 2023. Despite this rapid expansion, however, quick commerce has only captured a modest 7% of the potential market, with a total addressable market (TAM) estimated at $45 billion, surpassing that of food delivery, according to JM Financial. No wonder then, that Reliance’s Jio Mart is the latest to announce plans to enter this race.

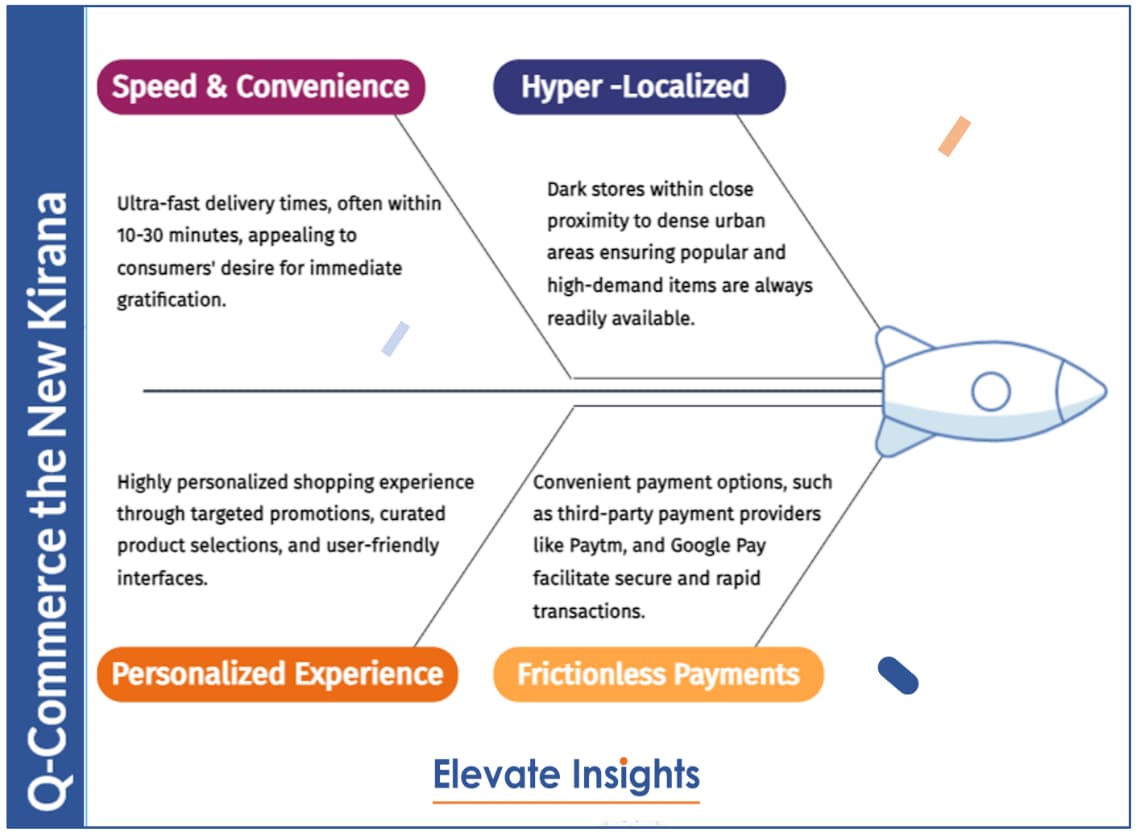

How did this seemingly non-starter industry become a rocket ship!!

1. Unique Product-Market Fitment: Quick commerce mimics the uber convenience and personalization of the traditional next-door mom-pop retail outlet with a reasonably wide and premium assortment like that of a Modern Trade. Analysts predict that many consumers would directly transition from traditional retail to Quick commerce, bypassing MT. From an operations perspective as well, Quick Commerce model hinges on a network of dark stores, with technology enabling players to optimize every second from optimized location identification of dark stores to assortment storage, packaging and billing. It takes some of the players 6mins to deliver an order that a consumer may have taken 5 minutes to place!!!!

2. Unique Audience Profile & Occasion Fitment: It helps the case that the Quick Commerce core user is pretty much the bulls-eye target audience of most of the new-age brands eyeing to disrupt consumer goods, especially in the Food &Beverage space in India. Further, the channel has high retention rates of close to 65%. This makes it a marriage made in heaven. This channel is fast becoming the most coveted space for advertising, new launch sampling and brand collaborations for all premium products.

A high number of digital first brands like GoDesi, GoZero, MasterChow, Dadi’s etc scale via quick commerce channels as it’s a perfect intersection of the right audience and right occasion fit given the impulse nature of their merchandise.

3. Moving beyond F&B into Ecommerce & Lifestyle and Gifting : Now, the Quick Commerce sector is seeing a variety of ecommerce and lifestyle products piggybank on its success as another legitimate way to reach a highly relevant audience. From lenskraft sunglasses, to toys, makeup and personal care items. Quick commerce is also fast eating into the share of the gifting market. Who needs to prebook via Ferns & Petals when you can order cake, flowers and special Mothers day, Valentine day gifts on quick commerce itself in minutes.

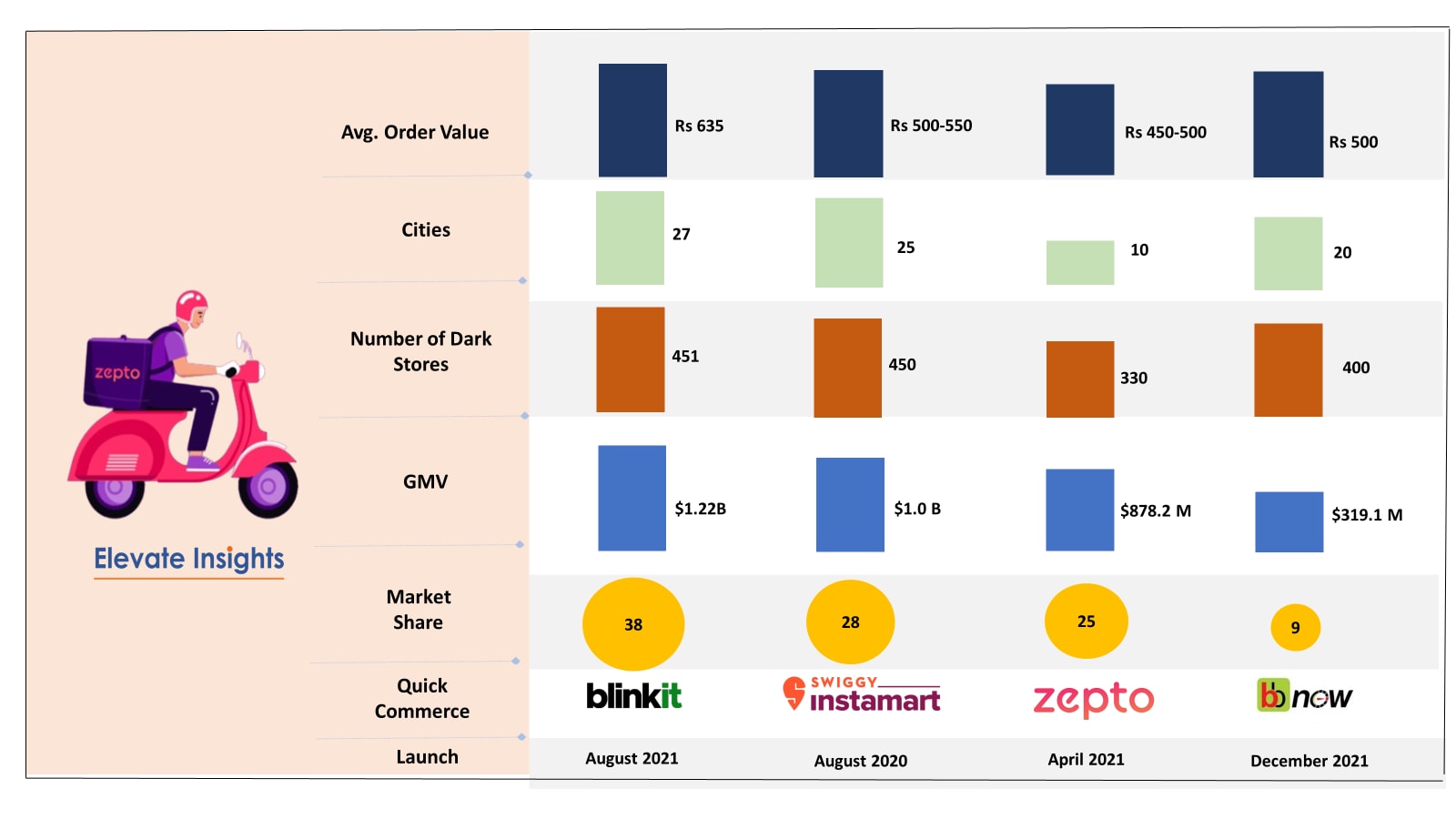

Even as Blinkit leads the show, Zepto is gaining momentum.

While Blinkit has been a dominant player in the Q-Commerce market with an estimated market share of 40%, as per a HSBC Global Research report, Zepto has been steadily increasing its market share from 15% in March 2022 to 28% in January 2024, at the cost of Swiggy Instamart, whose market share fell from 52% to 32% over the past two years leading the industry on all vectors.

That’s incredible, given that Instamart and Blinkit get the benefit of Foodtech customer base that Zomata and Swiggy had apart from the back end operational efficiencies. Big Basket has clearly a lot to catch-up to if its to remain relevant in the online grocery space.

Clearly, Quick commerce is the future of online grocery for India. Given the way Zepto is leading on all aspects of monetization, we reckon it may soon be the leader in this category.

Ruchira Jain is the founder, Elevate Insights – a market research and consulting firm. She was earlier VP Swiggy, Director PepsiCo.