Latest data from YouGov shows that celebrity beauty brands are popular among people and more than three in five urban Indian consumers (62 percent) say they have ever tried a beauty brand (skin, hair, nail, or makeup) owned by a celebrity. Among the various generations, millennials were most likely to say they have ever tried celebrity beauty brands (69 percent).

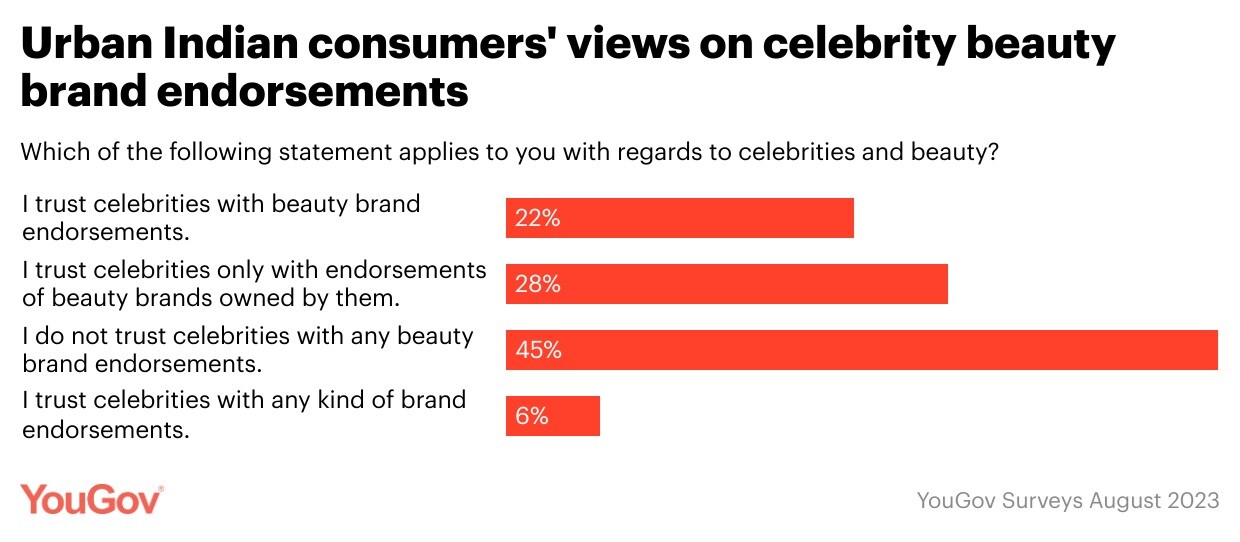

When it comes to trust, slightly over a fifth of urban Indians (22 percent) said they trust celebrities with beauty brand endorsements, while a slightly higher percentage (28 percent) trust them with advocacy of beauty brands owned by them. However, a large proportion (45 percent) does not trust them with any kind of beauty endorsements- for self-owned or other brands.

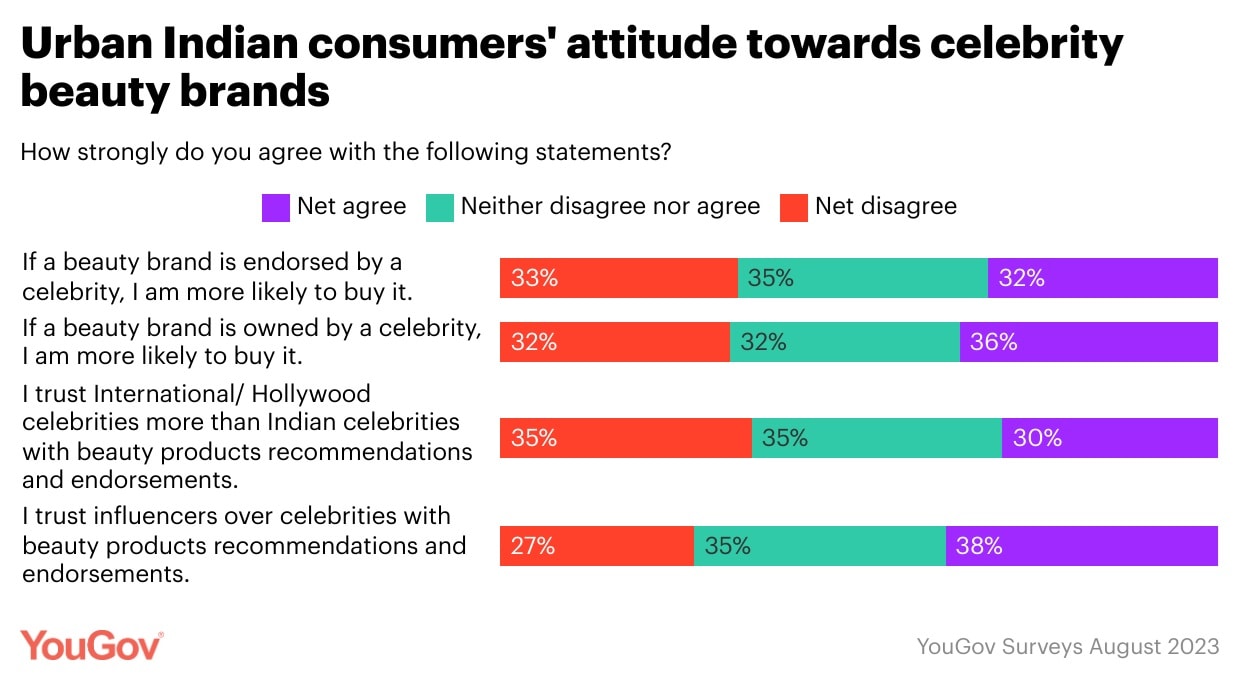

The data shows that consumers seem divided on their opinion of a celebrity’s influence on their purchase decision. A third say they are more likely to buy from a beauty brand endorsed by a celebrity (32 percent), and another third disagree with this view (33 percent). But when a brand is owned by a celebrity, they are more likely than unlikely to buy it.

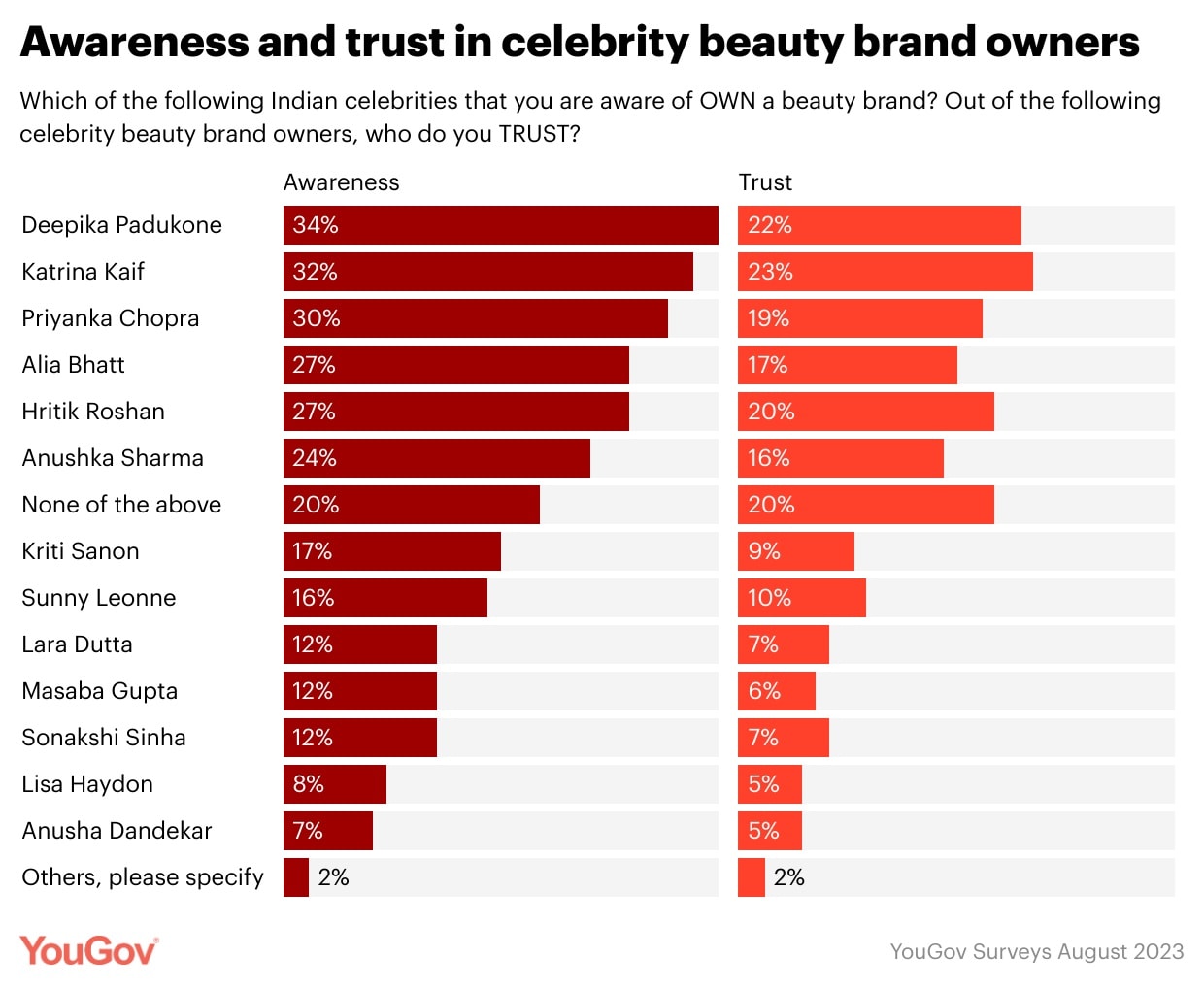

The high price of products was the biggest reason for a sour experience with celeb brands (68 percent), followed by poor quality products (38 percent) and misleading information or false claims (28 percent). When it comes to awareness of celebrities that own beauty brands, Deepika Padukone leads the table, with over a third of urban Indians (34 percent) saying they are aware of her owning a beauty brand.

Katrina Kaif and Priyanka Chopra follow in second (at 32 percent) and third (30 percent).

On the trust barometer, Katrina Kaif comes on top, with almost a quarter saying they trust her (23 percent). Deepika Padukone is a close second (at 22 percent). One in five trust Hritik Roshan (20 percent), and just as many (19 percent) claim they trust Priyanka Chopra.

It is interesting to see Hritik Roshan score high on awareness and trust in an industry dominated by women.

Even though Alia Bhatt and Anushka Sharma do not own any beauty brands, people associate them with this category and a sizeable proportion trusts them with recommendations, a great advantage should they want to start their own line.

Methodology: YouGov Surveys: Serviced provides quick survey results from nationally representative or targeted audiences in multiple markets. This data is based on a survey of adults aged 18+ years in India with a sample size of 1005 respondents. The survey was conducted online in August 2023. Learn more about YouGov Surveys: Serviced.