After four consecutive quarters of decline, global TV shipments grew 3% year-on-year (YoY) in Q2 2024 to reach 56 million units, according to the latest Global TV Tracker report jointly published by Counterpoint Research and DSCC.

Premium TV shipments surged 45% YoY on continued growth in Mini LED LCD TVs. OLED TV shipments saw YoY growth, but their overall market share remained low.

Regionally, the European market saw a 13% growth, benefiting from the pre-Olympics demand, while China’s market continued to struggle due to saturation.

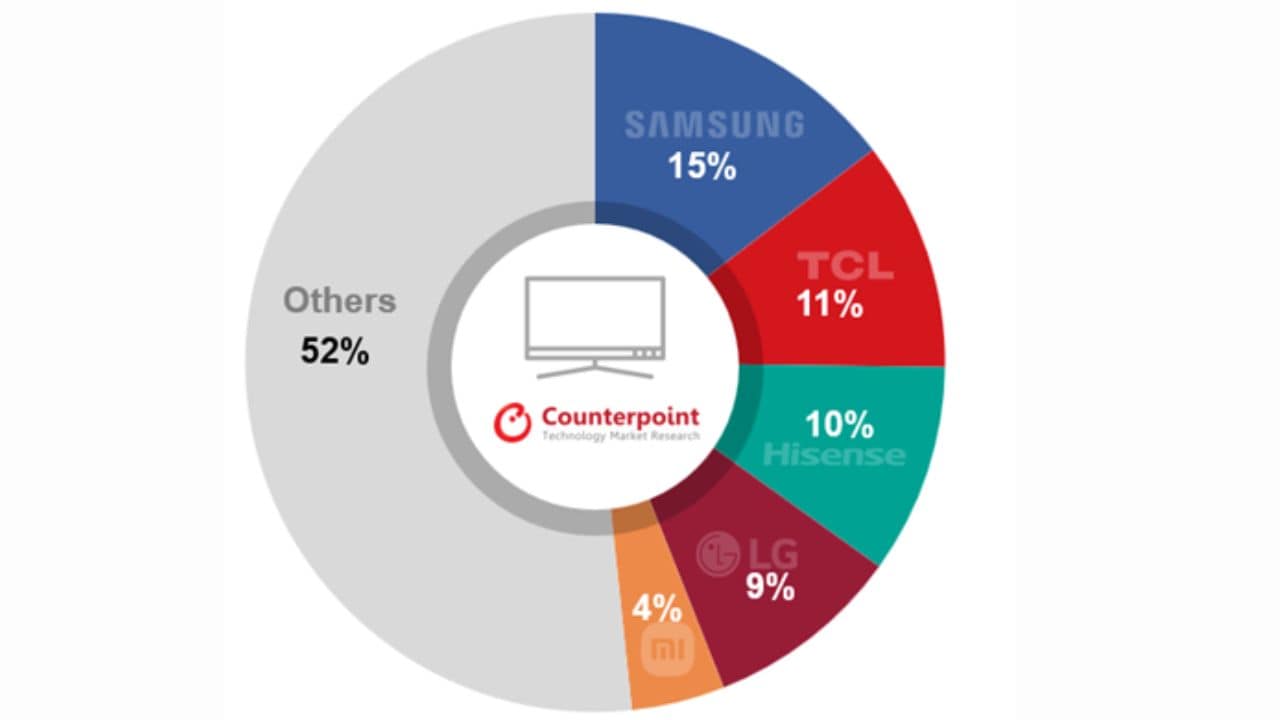

In terms of brands, Samsung maintained its market lead with a reduced share of 15%, narrowing the gap with the second spot. The intense rivalry between Hisense and TCL for the second spot saw TCL reclaiming the position by a slim margin.

LG, ranked fourth, recorded an 8% increase in shipments YoY, bolstered by strong performance in the European market.

In terms of price categories, Q2 market growth was driven by a 45% YoY increase in premium TV shipments, with most major brands except Sony showing strong gains.

Chinese brands Hisense and TCL led the growth, while Samsung saw only modest growth and its market share in the segment fell below 40% for the first time. In response, Samsung is reinforcing its position in the premium TV market by expanding its OLED lineup.

Recently, the brand launched 42-inch and 48-inch OLED TVs featuring LG Display’s WOLED panels, following last year’s launch of the 83-inch model.

Mini LED LCD TV shipments in the premium segment surged by 69% YoY, surpassing OLED shipments for the first time. This growth was driven by Chinese manufacturers’ strategic focus on Mini LED over OLED. Although OLED TV shipments grew by 21% YoY, signaling a return to growth, their overall market share remained limited.

Shipments of below-40-inch TVs declined by 7% YoY, while those of over 40 inches saw growth. The over-80-inch category saw 29% YoY growth. DSCC Senior Director Calvin Lea said, “Given the global economic downturn, the competitive pricing of 50-inch and larger Mini LED LCD TVs in the premium market is expected to sustain their growth trajectory for the foreseeable future.”

Counterpoint Research Associate Director Sujeong Lim said, “The rebound in the TV market in Q2 was anticipated against the backdrop of approaching Olympics in Paris. While Europe showed significant growth, Asian markets excluding China and Japan, and Latin America also performed better than expected.”