Influenced by a heatwave, a seasonal slump, and slower demand from Q1 2024, India’s smartphone shipments fell 2% year-on-year (YoY) in Q2 (April-June) calendar year (CY) 2024, according to Counterpoint’s ‘Monthly India Smartphone Tracker’ report.

In response, OEMs hosted sales events in Q2 to clear inventory, leading to a reduced sell-in and a period of degrowth.

“Heatwave conditions in various regions led to lower footfalls in offline channels and delayed smartphone purchases as consumers prioritised appliances like air conditioners and refrigerators. This reduced demand caused an inventory build-up. However, summer sales at online channels, good harvest, and aggressive promotions towards the end of the quarter provided relief to OEMs, helping close the quarter on a better note than at the beginning,” noted Senior Research Analyst, Shilpi Jain.

The report claimed that Q2 recorded the highest-ever value.

Commenting on the market’s value dynamics, Research Analyst Shubham Singh said, “In Q2 CY24, India’s smartphone market achieved its highest ever Q2 value, driven by the ongoing trend of premiumisation. Consumers continued to upgrade to higher-value smartphones, supported by better trade-in values and easy financing schemes. This resulted in a 24% YoY growth in the ultra-premium (>Rs 45,000) segment.”

The report also pointed out that the Rs 20,000- Rs 30,000 and >Rs 45,000 price bands saw the fastest growth at 25% and 24% YoY respectively.

Additionally, in Q2, 5G smartphone shipments in India hit a record 77% share of the overall smartphone market, driven by their declining average selling prices (ASPs). OEMs are competing to launch cheaper 5G models, with Lava introducing the Yuva 5G during the quarter.

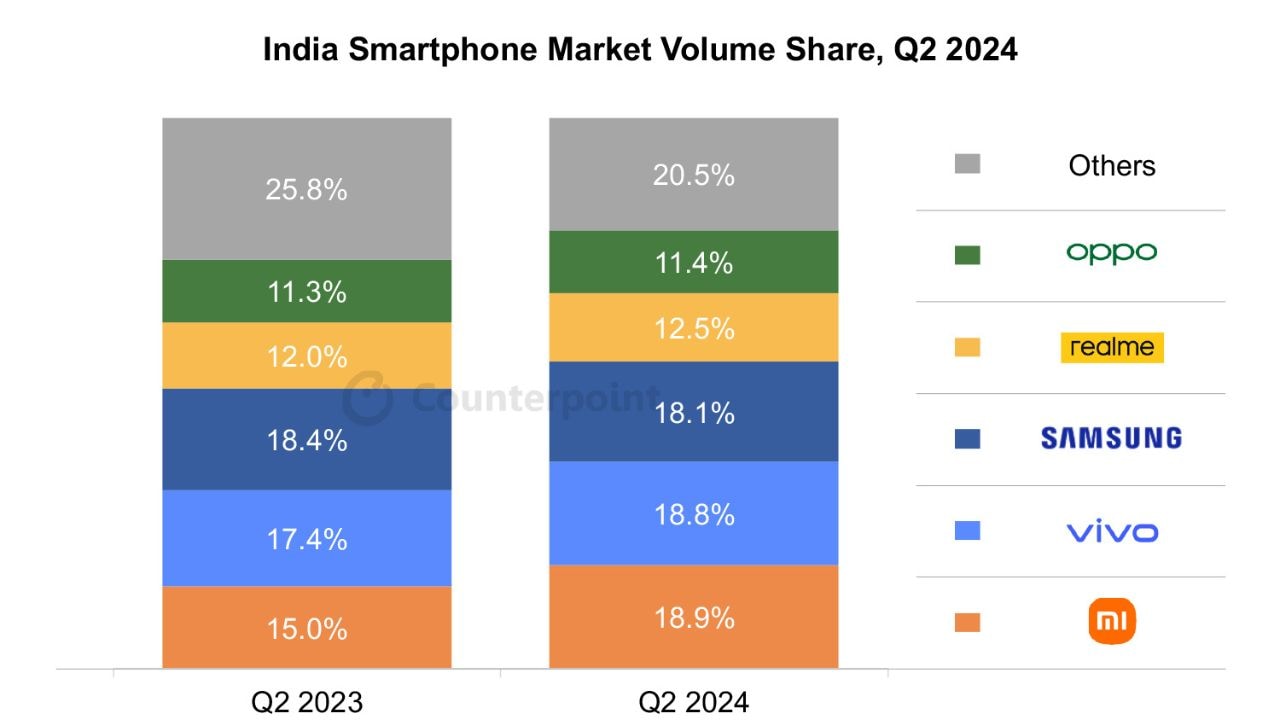

During the quarter, Xiaomi reclaimed the top spot with a 23% YoY growth in its shipments, driven by a streamlined and focused portfolio that spans from the entry-level to affordable premium segments. To further solidify its position, the company employed a strategy to push flagship handsets, improve marketing and expand distribution channels.

Samsung led in value terms for the second consecutive quarter, capturing over one-fourth of the market. Its new Fold 6 series is expected to sustain this leadership. With the brand focusing on value over volume, its ultra-premium segment (>Rs 45,000) grew by 99% YoY in Q2 CY24. vivo took the second spot, driven by its higher-priced models like the V30 series with enhanced cameras.

Meanwhile, Apple ranked third in value terms. But it is expected to rebound in the next quarter, driven by the recent price cuts across the entire range of iPhones, added Singh.