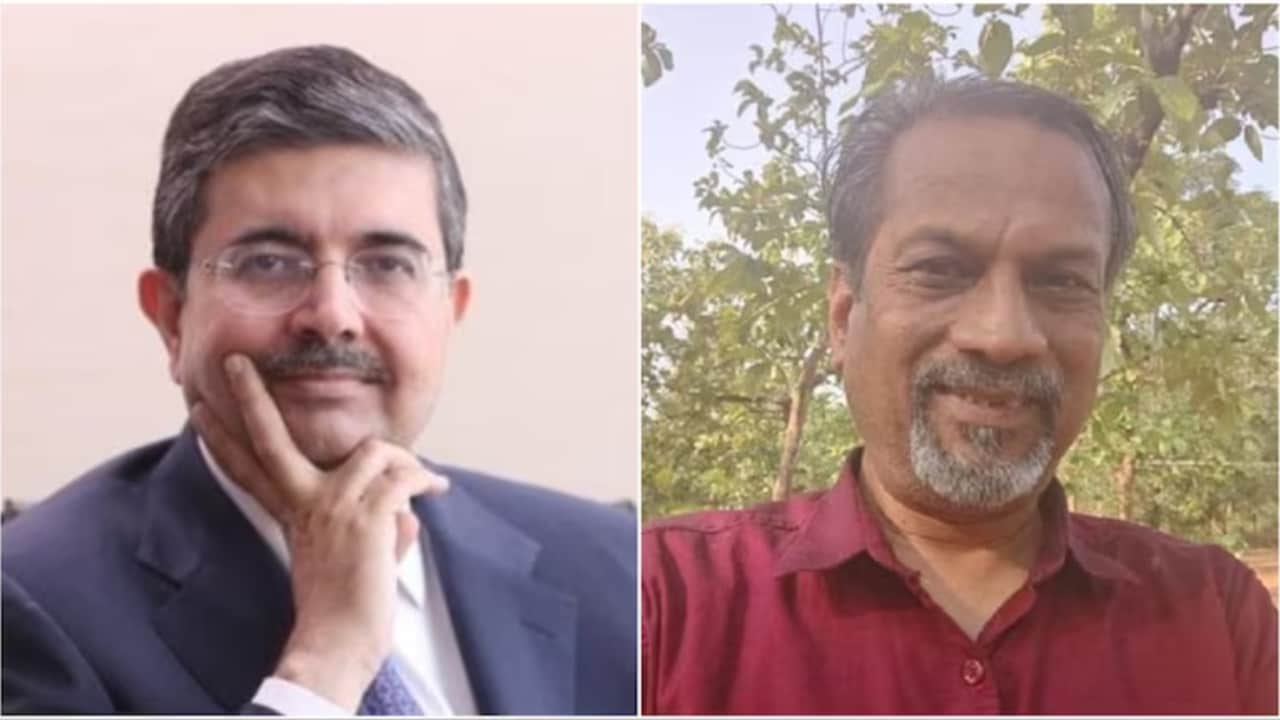

With gold prices crossing the ₹1 lakh per 10 grams mark in India, Kotak Mahindra Bank founder Uday Kotak took to social media to spotlight an unlikely financial hero — the Indian housewife. In a post on X, Kotak praised the enduring trust Indian women have placed in gold, calling them “the smartest fund managers in the world.”

Citing gold’s long-term resilience as an asset, Kotak commented, “Governments, central banks, economists… may need to take a leaf from India — a net importer of store of value forever!” His remarks struck a chord, particularly ahead of Akshaya Tritiya, a key gold-buying festival in India, where spot prices of 24-karat gold jumped ₹1,650 in Delhi alone.

Among those echoing Kotak’s view was Sridhar Vembu, Zoho’s co-founder and chief scientist. Vembu highlighted the cultural and economic foresight behind India’s affinity for gold. “Money is too important to be left to central banks and PhD economists,” he posted, taking a swipe at both modern monetary policy and cryptocurrency. “Gold is money. The poorest Indian knows this — and that knowledge is power.”

The conversation has sparked debate online, with some pointing out that gold-buying traditions have also stemmed from limited access to formal financial systems. Still, the timing of Kotak’s praise — as bullion becomes a hedge against political and market uncertainty — underscores how traditional instincts may yet prove smarter than modern finance.