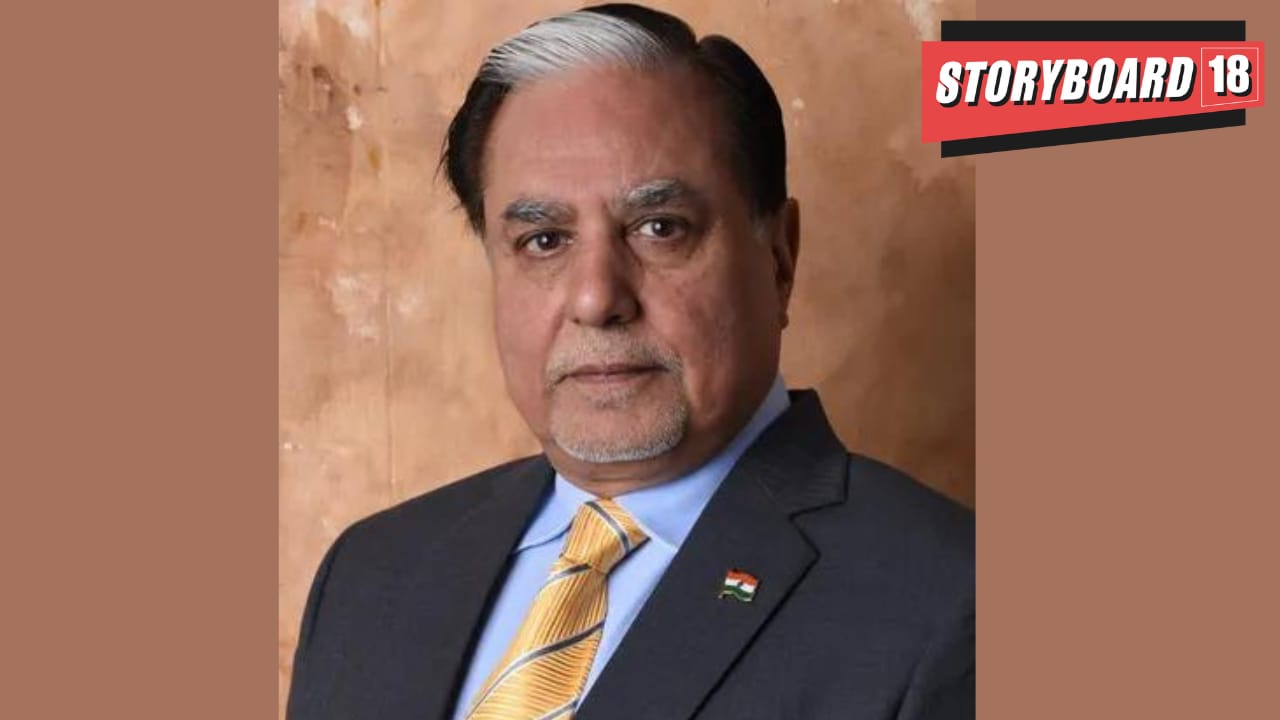

The National Company Law Tribunal (NCLT) in Delhi on April 22 admitted Indiabulls Housing Finance Ltd’s (IBHFL) personal insolvency plea against Zee Entertainment Enterprises Limited (ZEEL) chairman emeritus Subhash Chandra over guarantees given to a company called Vivek Infracon. The tribunal in Delhi also dismissed pleas by IDBI Trusteeship and Axis Bank against Chandra’s admission to personal insolvency, Moneycontrol reported.

Consequent of Chandra being admitted to moratorium, no litigation can be initiated against him. Chandra also cannot alienate or sell any of his assets. The resolution professional (RP) will be appointed to process the claims of those seeking to recover money from him.

IBHF claimed that while Chandra indicated of a settlement being reached in the dispute, it has not fructified even after months, as per the report. Thus, they are constrained to revive the personal insolvency plea. The plea was filed under the Insolvency and Bankruptcy Code, 2016 (IBC). IBHF had moved a petition to initiate personal insolvency against Subash Chandra in 2022 after a loan of Rs 170 crore it had given to Vivek Infracon had turned into non-performing assets. Chandra argued that NCLT cannot rule on an individual’s insolvency.

On May 30, 2022, the tribunal ruled that it had the powers to rule on Chandra’s solvency and appointed a resolution professional to consider Indiabulls’ application. However, the case had gone into cold storage after provisions relating to personal guarantee under IBC were challenged in the Supreme Court, the report added. The apex court had in June 2022 asked the resolution professionals of personal guarantors not to act on their mandates.

In November 2023, the Supreme Court upheld the validity of these provisions, providing companies with a clear way to reinstate cases against personal guarantors. Thus Indiabulls Housing Finance revived the plea.